How can a cow, living in an environment of 50 degrees plus centigrade, be able to generate so much cash flow out of what is essentially a very competitive commodity? A refreshing perspective on the company’s credit risk. According to the company’s website, Al-Marai was established in 1977; “… From relatively modest beginnings, we have grown into the world’s largest vertically integrated dairy operator. Synonymous with dairy products of the highest quality, diversifying into fruit juice, bakery and poultry products has also made Almarai a food company.”

This well-known food company has remarkable historical performance with a financial rating of 3.35 (using 6 Sigma’s Credit Risk System). An investment grade company par excellence, what we consider at 6 Sigma as a Category 1 company.

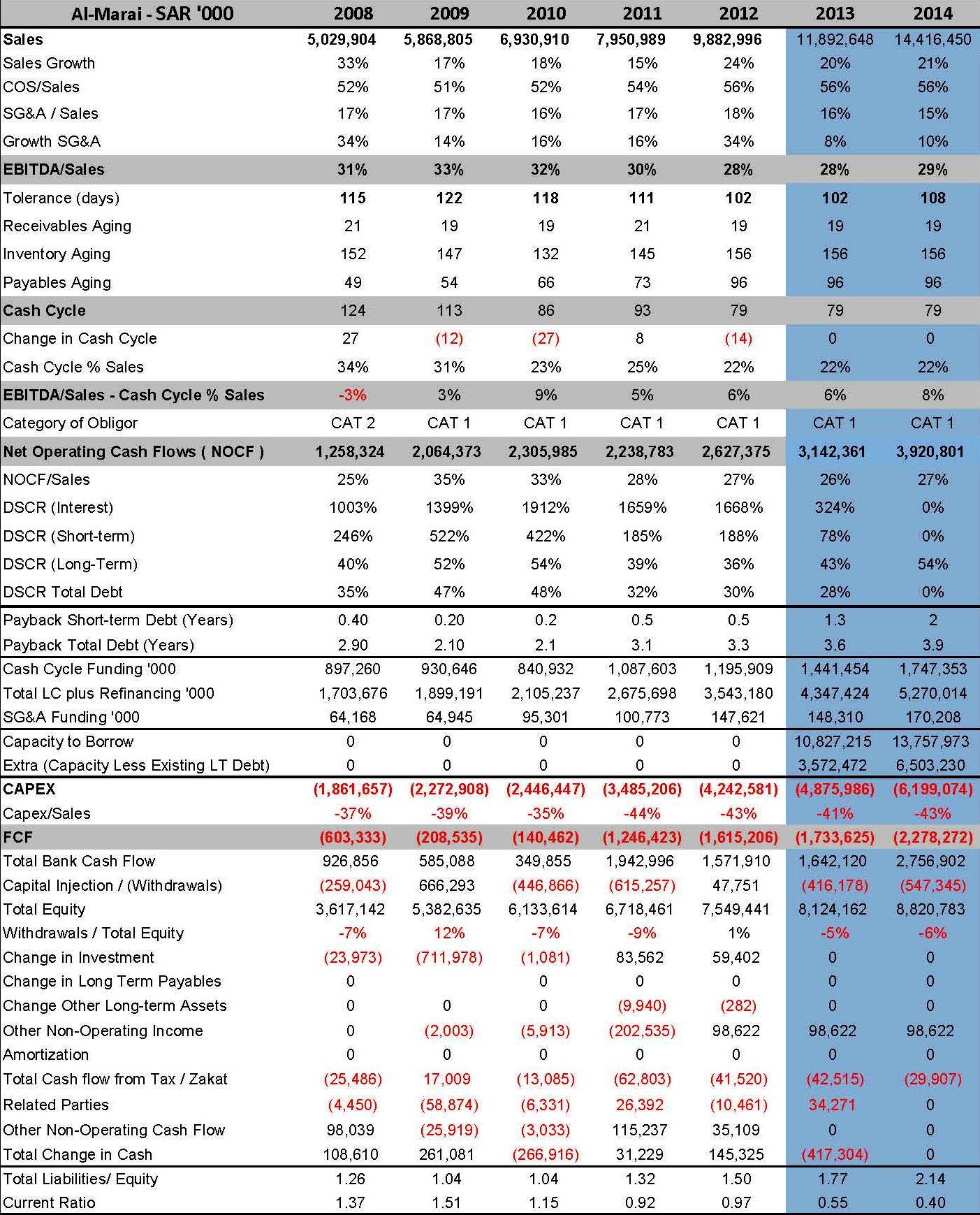

Using 6 Sigma’s signature credit risk analysis methodology, a “Category 1” company is one that continues to generate cash as it grows. As reflected in the company’s 2014 financials, Net Operating Cash Flows (or NOCF) reached a high of SAR 2.6 bn (USD 730 million), an impressive 27% of sales (albeit reduced from the dizzy heights of 33% of sales in earlier years).

On the positive side then: Zooming in closer on why the cash flows remained strong, we found the following positive results:

- Double digit growth in sales throughout the 2008-2012 period; reaching SAR 9.8 bn in 2012 (USD 2.7 bn). Sales in this regard remained mainly dairy products and derivatives; and spanned several countries including the GCC, Levant and Egypt.

- We believe that the company’s EBITDA margin reduced from 33% in 2009 to 28% in 2012 due to its expansion into very competitive products and markets such juices and Egypt. No matter what, 28% is still considered high for a company that specializes in essentially dairy products production.

- In addition, the company managed to reduce its cash cycle from a high of 124 days in 2008 to 79 days in 2013, thanks to maintained control over receivables, and an increase its payable aging. The inventory aging increased back to 156 days from a low of 132 days a few years earlier, in line with the expansion into products that require longer shelf life and added packaging.

One interesting aspect is the low Current Ratio 0.97 in 2013 and a relatively high leverage ratio of 1.5. This is yet another example of why these ratios are clearly not indicative of credit worthiness.

And the cash flow was enough to cover debts. The company lived well within its means. Despite having bank debt, the cash flow was more than sufficient to meet all its commitments to banks with a Short Term DSCR above 100%, and a total DSCR of 36%.On the negative side however: Imagine a cow, living under 50 degrees (or more) conditions, requiring air-conditioning to survive, eating food that is not found naturally locally, drinking water in the desert, and producing what is essentially a commodity product. Yet, the owner of this cow is able to sell this product at a very high margin.

If we were to compare this cow with a Swiss equivalent, that drinks naturally available water, eats naturally available grass, and does not require so much energy to survive, we should expect an EBITDA of around 8% (versus 28% for Al Marai). So how does Al Marai achieve this high margin?

The answer is in government subsidies. The land is virtually free, water is also free, food is almost free, and energy costs are highly subsidies. A truck full of dairy products can cross vast spaces with relatively limited costs if its fuel charges were insignificant. This is why Al Marai’s COGS% are 56%, and EBITDA 28%, allowing the company to tolerate 102 days in changes in its cash cycle, which in any case is well managed.

So how much should you finance? As long as Government subsidies (direct or indirect) remain in place, and Marai does not venture too deeply into markets where subsidies are not evident (Egypt etc), and/or into new products that are too competitive, then the company should be able to continue producing the levels of cash it has in the past. In this regard, and given these main overlaying risks, a banker would be wise to treat the company as a strong Category 2 (risk rated 5) rather than a Category 1 obligor (risk rated 4). In this respect, bankers would be wise to structure the facilities as follows:

1. Aim for 50% of its wallet with a tenor of up to 7 years in financing. 2. In this regard, the company’s wallet is assessed as: a) Total LC Limit of SAR 5.2 Bn, with SAR 1.7 Bn in cash cycle funding, b) SG&A financing of SAR 170 million, and c) With Capex (at 43% to sales), and given the strong cash generating ability, the company should be able to raise SAR 3.6bn in new bank debt with ease. This represents 75% of its expected capex requirements in 2014. Below are financial highlights. Those in blue are projections. © 2014 6 Sigma Group

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE?

You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”

© 2014 6 Sigma Group

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE?

You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”