Take UAE’s largest. Julphar was established in 1980, and is involved in the production and distribution of pharmaceutical products through a network of twelve manufacturing plants (with further expansion planned), and a logistics network across five continents (www.julphar.net). The company enjoys a diverse product range covering major therapeutic segments and has recently ventured into the production of raw material needed to make insulin. It is rated by 5.47 by 6 Sigma; what we classify it as a Category 2 obligor in terms of credit risk.

The Good News As at 12 March 2014, the company’s capitalization stood at AED 3,245 million, covering 863 million shares (price per share AED 3.76), had a Price per Earnings of 13.5, and an EBITDA multiple of 11.2. Its payouts to shareholders remained consistent at least over the past 5 years, reaching AED 87 million in 2013, representing 5% of Equity (http://goo.gl/AbPYFM).

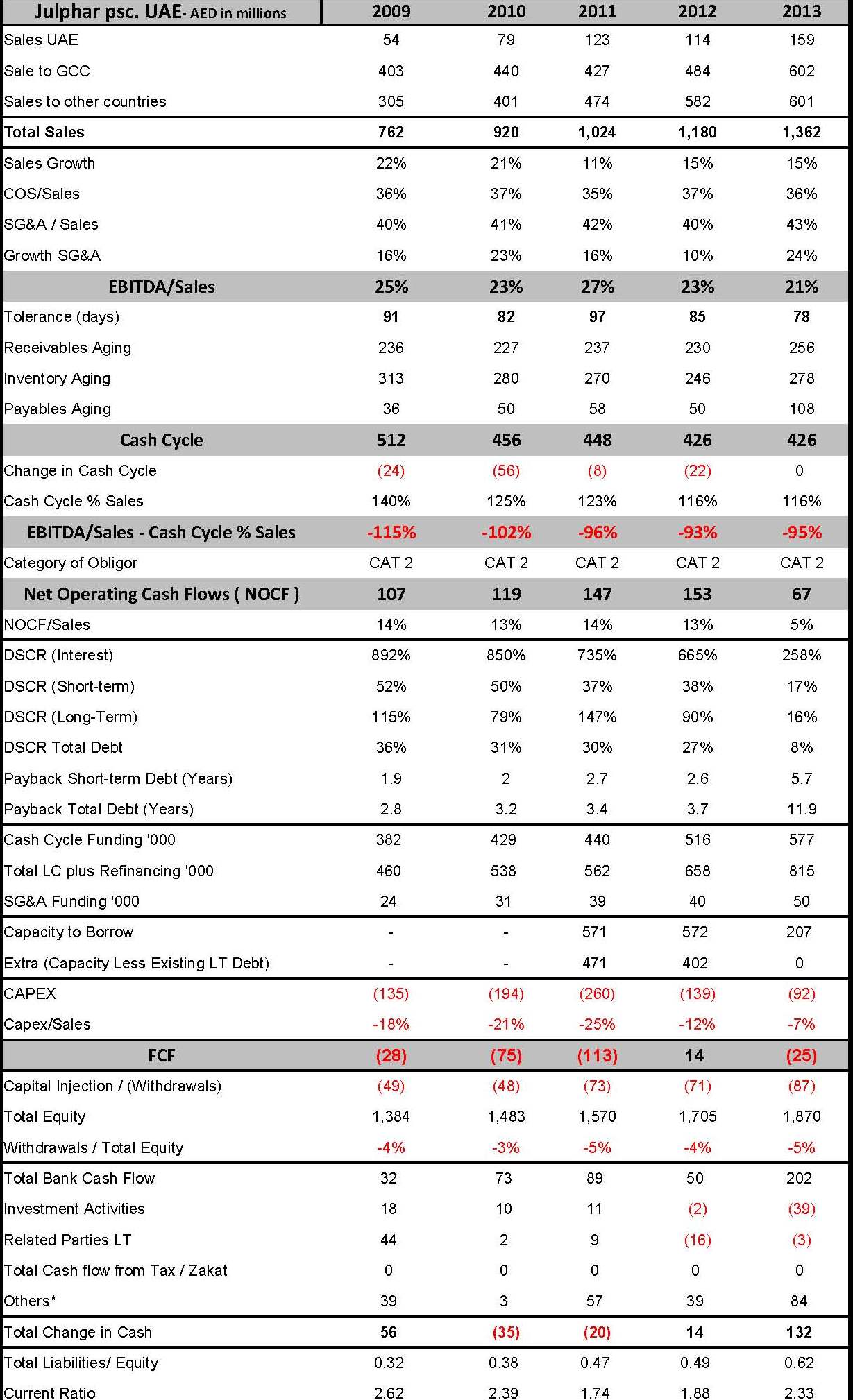

The Not So Good News From a credit risk perspective, the company has shown difficulty in generating consistent and high levels of cash flow; with Net Operating Cash Flow (NOCF) reducing from 14% of sales in 2009 to 5% of sales in 2013. This is what we term as a worsening Business Model. That was due to the following:

-

Increasing Sales (CAGR 16% since 2009) reaching AED 1.4 Bn in 2013; whilst reducing EBITDA margin from 23% in 2012 to 21% in 2013;

-

Very high Cash Cycle, which despite the reduction from the dizzy highs of 512 days in 2009, remained very high at 426 days in 2013.

During the same period both capex and bank debt increased:

-

Capital increased from AED 686 million in 2009 to AED 863 million in 2013.

-

Bank Debt increased consistently every year, by as much as AED 414 million from 2010 to 2013.

The Group has (and seems to have always had) the wrong Business Model, and it maintained dividends partly through increased capital and bank debt. The catch here is that the only reason this company managed to produce cash flow in the first place during this period is because it managed to maintain EBITDA margins steady (except in the last year), and reduced its cash cycle by as much as 86 days during the same period. The latter was the equivalent of an EBITDA margin of 23%. If the company were unable to manage EBITDA and/or reduce the cash cycle further in future years, then any growth in sales will lead to a severe reduction in NOCF. With an already negative FCF, future valuation is expected to remain negative.

Is this unique to the Industry or the Company? The industry is certainly growing with (a) mandatory health insurance in the region, and (b) the increasing levels of diabetes and obesity. However the symptoms of the pharma companies are the same. Take SPIMACO, a Saudi listed company that has similar margins to Julphar’s, the same wrong business model, and the same reduction in NOCF margins.

So why do banks fall over backwards to finance it? The reason why banks are enamored with the likes of Julphar is probably due to strong traditional ratios:

-

growing balance sheet and income statement,

-

high current ratio (2.3:1 in 2013), and

-

low Leverage (0.6:1 in 2013);

what the Basel Guidelines refer to as “Simple Indicators”. Had banks realized that it would take the company 6 years to payback what is essentially short term bank debt, and 12 years for total bank debt, their support would probably not be as generous. A more elaborative description of this phenomena can be seen in our 5 Common Mistakes in Credit Analysis which can be acquired from https://ki156.infusionsoft.com/app/form/default-campaign-form.

As for the reason why the company’s share price remains relatively high is perhaps due to a very high, and in our opinion unrealistic expectation of a much improved company performance in the future.

6 Sigma will publish an international industry average covering the major players in this sector. If you are interested in receiving these results, please contact us on ramzi.watfa@6sigmagrp.com.

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at https://www.credit-risk-store.com/”