How to Detect and Manage Fraud in Credit Risk

Providing Officers with Best Practices in selling Credit Risk

How to Manage Credit Risk in Name Lending

Why is Suez Cement’s Credit Risk so low?

How Good is Bisco in terms of Credit Risk?

What are the Credit Risk impact of Tesco’s accounting scandal?

What to do with Credit Risk Ratings?

Being Proactive in Credit Risk Management

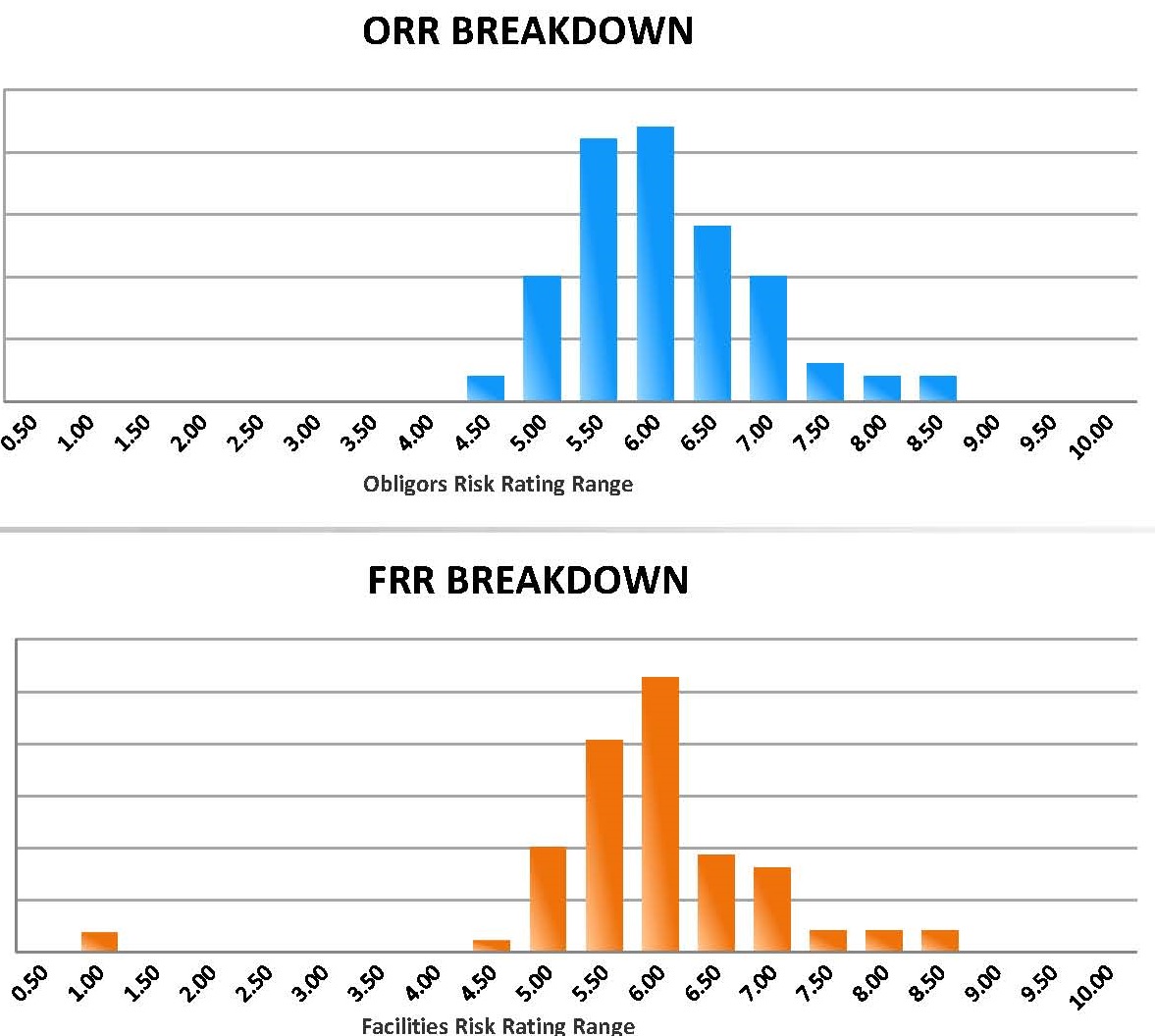

Portfolio Risk Rating in Managing Credit Risk

Credit Risk issues at your finger tips

Get the

5 Mistakes

Bankers Do in

Credit Analysis

You’ll discover what the 5 mistakes are and how to avoid them.

PLUS, you’ll get a free subscription to our weekly newsletter.

We promise to never sell, rent, trade or share your email with any other organization.

Browse the

Credit Risk Store

The simple methodology used in our Essentials of Accounting online course allows you to understand ...

Learn More About This E-Course HereThis Financial Analysis online course shows you how to assess the company’s business model and its ability ...

Learn More About This E-Course HereSigma’s Credit Risk Management online course series are intended to introduce methodologies that makes credit ...

Learn More About This E-Course HereThe Portfolio Risk Rating and Stress Testing online course is designed to help you understand how to create ...

Learn More About This E-Course HereThe Facility Structuring online course shows you, step by step, how to identify both the short-term and long-term ...

Learn More About This E-Course HereIf you’re already analyzing obligors, and generating credit risk ratings for individual clients, this Credit Analysis ...

Learn More About This E-Course Here