According to Deloitte’s recent publication titled Global Powers of Retailing 2014 (http://goo.gl/Wj4FEP), of the 250 largest retail stores in the world, EMKE Group (the Lulu chain) was reported as the 197th largest. The Group had a CAGR in revenues of 25.3% over 2007-2012, with current estimated sales of USD 4.5Bn (not sure if this is correct though). Although this is almost 1% of Walmart’s sales of USD 469Bn (the top of the list), EMKE Group’s plans include opening 42 new hypermarkets in the next 2 years bringing the total to above 110 in the Middle East. It is also expanding with cold stores in India. Its Managing Director, Mr. M.A. Yusuff Ali MA is reportedly the 40th richest Indian with a networth of USD 2.2Bn. Wow, from a credit risk perspective, the Group must be at the top of the list of credit worthy clients in the region.

I mean EMKE Group shares a list of the most prestigious names, including the likes of: Ranking, Name and Country 1 Walmart USA 2 Tesco PLC UK 4 Carrefour SA France 7 Metro AG Germany 15 Woolworths Ltd Australia 25 Safeway Inc USA 28 J Sainnsbury plc UK 39 Migros-Genossenschafts Bund Switzerland 42 Mercadona SA Spain 57 Marks and Spencer Group plc UK 59 The Gap Inc USA 61 Coop Italia Italy 69 John Lewis Partnership plc UK 78 S Group Finland 92 Shoppers Drug Mart Corp Canada 149 President Chain Store Corp Taiwan 162 Lojas Americanas SA Brazil 165 Sonae, SGPS SA Portugal 197 EMKE Group/Lulu Group Intl UAEThat’s the good news. The bad news is that the group is privately owned and therefore does not release its financials to the public; so we are unable to judge whether its credit risk position is gained out of a strong control over its business; simply due to lack of real competition in the middle east; or if the Group is riding a wave in increased demand for local hypermarkets whilst the rest of the industry worldwide is moving in another direction.

In any case, why don’t we take as an example the largest retailer in the world, Walmart and analyze its engine. Perhaps there are tricks to this business that we can learn and apply to others.

First off, Walmart is rated 1.85 using 6 Sigma’s Credit Risk System, Aa2 by Moody’s and AA by S&P, which is an excellent rating by any measure. That is why it can borrow so much, so cheaply (http://goo.gl/t0vpLj). Let’s see why:

First off, Walmart is rated 1.85 using 6 Sigma’s Credit Risk System, Aa2 by Moody’s and AA by S&P, which is an excellent rating by any measure. That is why it can borrow so much, so cheaply (http://goo.gl/t0vpLj). Let’s see why:

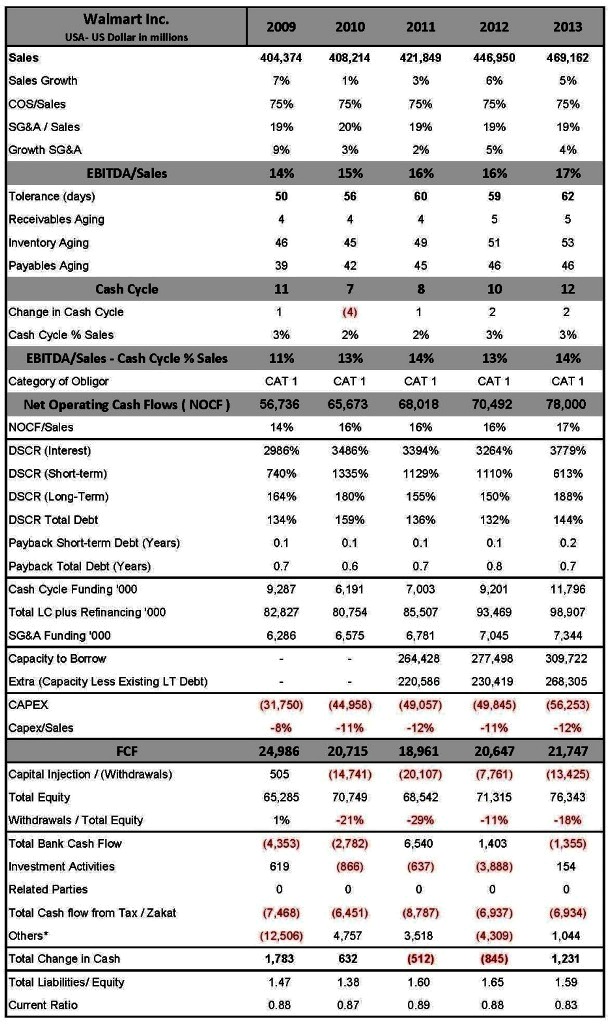

A Category 1 company by any measure, with continued improvement in results Sales reached USD 469Bn in 2013. The company experienced single digit increases in sales since 2009 (a CAGR of 3.8%), which for a company of its stature, operating in a yet to fully recover economy, is quite an achievement. Thanks to relatively curtailed overheads, EBITDA margins increased gradually from 14% of sales in 2009 to 17% in 2013. At these levels, the EBITDA can withstand 62 days in changes in the cash cycle.

However what is more interesting, the cash cycle remained very low, at 12 days in 2013 thanks mostly to a well controlled inventory and payable levels. This translated to 3% of sales, and relative to an EBITDA of 17%, its engine was a positive and healthy 14%, an improvement from 11% in 2009.

So thanks to sustained growth rates, Net Operating Cash Flows (NOCF) reached USD 78Bn in 2013, an increase from 14% of sales in 2009 to 17% of sales in 2013. It is quite an achievement for a company to be able to reach Category 1 status, and improve its engine over time.

The Cash was also enough Not only was NOCF positive and growing, its DSCRs were very comfortable. DSCR Interest was a whooping 3779%, Short Term Debt a very high 613%, and Total Debt 144%. No issues with regards to an ability to repay its debt and bond obligations. So from a Credit Risk point of view, this company continued to portray a very low risk profile.

Did the shareholders benefit? Absolutely. The ratio of withdrawals to equity ranged between 29% and 18% over the past 5 years, remarkable by any measure. We will check whether capitalization levels were sufficient or not under a separate Newsletter.

How about Traditional Ratios, what did they show? Walmart is another example of why traditional ratios do not work. Despite the ability to generate high cash flow, and a healthy ability to repay bank debt, the company’s Current Ratio remained below 1:1, at 0.83, and its Leverage a high 1.6 in 2013.

So is Walmart typical of retail stores? It is wise to assume that if a retail company was able to ride economies of scale (with a well oiled supply chain, a large and growing distribution network whilst tightly controlling overheads), its EBITDA margins stand to improve with time. The trick though is whether the cash cycle can be controlled efficiently. Some of these stores tend to move into wholesale trade, which increases receivable agings. Some tend to overstock the shelves and may not have a very robust mechanism to manage inventory levels, and so have a tendency to increase inventory aging. Finally, there is a finite limit to how much you can squeeze your suppliers. So the retailer that makes it is the one that can manage all these factors effectively, and sustain a category 1 credit risk position.

6 Sigma will review other retail companies in the above list to see if this picture remains evident or not, and whether Walmart’s financial features are nothing but an oddity. So stay tuned to future Newsletters. Future Developments in the market and how that applies to regional players According to the Deloitte study, there are future challenges in this sector. There seems to be a paradigm shift with the use of technology, such as:

- RFIDs (radio tags) for security, ease of checkouts, and efficient inventory control;

- Digital assistants to reduce overheads, focus sales pitches, and create customer demand;

- 3D Printing to produce stock on demand without the need to stock; and

- Biemetrics, the cashless, point of sale and quickness of turnaround.

As such, competition is expected to increase further, and the first to incorporate the new technology in its stores, and distinguish itself through offering customers with a superior experience stands to succeed.

6 Sigma will publish an international industry average covering the major players in this sector (excluding EMKE of course where financials are unavailable). If you are interested in receiving these results, please contact us on ramzi.watfa@6sigmagrp.com.

© 2014 6 Sigma Group While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma. WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it: “6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”