How much would you lend beverage giant Diageo if they came knocking at your door? Here is a banker’s perspective on the leading beverage company’s credit risk.

Diageo PLC (UK) is, according to the company’s website, “the world’s leading premium drinks business with an outstanding collection of beverage alcohol brands, such as spirits, beer, and wine. These brands include Johnnie Walker, Crown Royal, J&B, Windsor, Buchanan’s and Bushmills whiskies, Smirnoff, Ciroc and Ketel One vodkas, Baileys, Captain Morgan, Jose Cuervo, Tanqueray, and Guinness.”

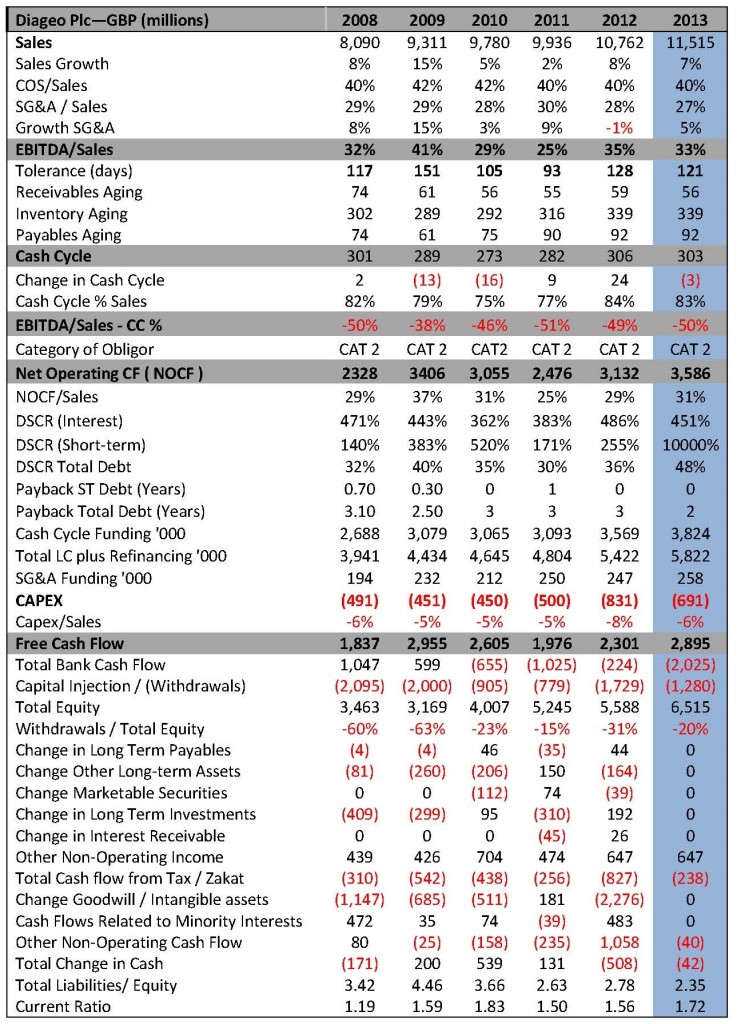

Using the 6 Sigma Credit and Risk Management System, the UK listed company has a rather impressive financial rating of 3.34. A summary of our analysis showed that 2012 remained a strong year in terms of cash flows for Diageo PLC DESPITE the fact that growth in sales for a “Category 2” company normally results in lower cash flows.

Using 6 Sigma’s signature credit analysis methodology, a “Category 2” company, the company’s cash generating ability experiences stress when growing. Cash Flows (as reflected in the company’s 2012 Net Operating Cash Flows (or NOCF) remained strong because the company’s profitability offered a high tolerance to changes in the cash cycle.

Zooming in closer on why the cash flows remained strong, we found the following positive results:

Higher than expected growth in sales The maker of Johnnie Walker whiskey and Guinness beer enjoyed an 8% growth in sales in 2012 beating analyst expectation of 5%, thanks to Africa Diageo’s biggest emerging market in 2012 .

Increase in Operating Profitability The EBITDA increased from 25% in 2011 to 35% in 2012, thanks to strict control over expenses; which provided it with a tolerance in changes in the cash cycle of 128 days (based on our 8.2% versus 30 days rule).

On the negative side:

High Increase in Cash Cycle The company carried a high cash cycle of 306 days in 2012 due mainly to inventory aging (of 339 days), resulting in a gap with EBITDA of 49% (that’s why it’s a Category 2 obligor). This level of stock aging is very high and normally indicates trouble particularly as it continued to rise since 2009. Obviously production continues apace without commensurate sales; despite coining the phrase, “it certainly is liquid”. Given that the older the stock is, the more valuable it becomes especially for a company where much of its revenue comes from hard liquor, this level of stocking may not be that dangerous after all.

So while growth in sales normally indicates lower NOCFs for a Category 2 company, in this case, thanks to the high EBITDA tolerance levels versus a change of only 29 days in the cash cycle over the 2011 – 2012 period, NOCF remaining strong and increasing to reach 29% of sales in 2012 (versus 25% in 2011).

And the cash flow was enough to cover debts.

The company’s Debt Service Coverage Ratio (DSCR) was very healthy throughout (255% short term, 42% Long Term, and 36% total debt) with a steady payback period of (3yrs) for the company’s debt in the past years. It seems the company lives within its means quiet comfortably.

So how much should you finance? Diageo PLC is a strong Category 2 grade company, and despite the high gap in the Engine, (due to the spirits no doubt!), bankers would be wise to structure the facilities as follows:

- Aim for 40% of its wallet with a tenor of up to five years in financing.

- Since the company seems to be aiming for more expansion in the emerging markets (capital Expenditure increased by 66% in 2012), then the wallet size would seem large and growing. In this regard, the company’s wallet is assessed as:

- Total LC Limit of GBP 5.4 Bn, with GBP 3.5 Bn in cash cycle funding,

- SG&A financing of GBP 247 mil, and

- Long-term Debt Financing of 5 bn – based on volatility of 24% in its historical NOCF, a financing tenor of 5 years for such a Category 2 obligor, and a projected NOCF of GBP 3.5 Bn, the company’s long-term debt capacity is calculated at GBP 12.4 bn. Given an existing GBP 7.4 Bn in long term bank debt, this leaves an extra 5 bn in additional borrowing. In view of an anticipated GBP 681 of Capex requirements in 2013, there should be no problem in acquiring such bank support.

© 2014 6 Sigma Group

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”