You may not know it, but you will be exposed to close to 64 times the Expected Loss provisions under IFRS 9 than what you are capturing under NPLs today. By all standards, this is a very large increase in provisions, and action needs to be taken now to manage this eventuality.

Background – just in case you missed it For those of you who need more background on the topic, I refer you to our three previous articles on the subject:

- Are you ready for IFRS 9 impact on Credit Risk? http://goo.gl/hdsZHj

- The impact of IFRS 9 on Credit Risk – part 2 http://goo.gl/ZO8gBd

- The pitfalls of applying IFRS 9 in Credit Risk http://goo.gl/MDJdVK

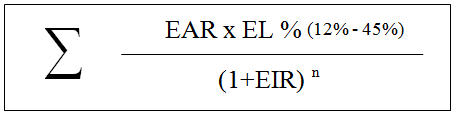

The Maths The formula for calculating IFRS 9’s impact is as follows:

Which is essentially the sum of all facility Exposures at Risk (EARs) multiplied by their respective ELs (or ECLs as per IFRS9), NPVed using the Effective Interest Rates (EIR), all the way up to their respective maturities. The 12% – 45% are the ECLs for Stage 2 going onto Stage 3 clients.

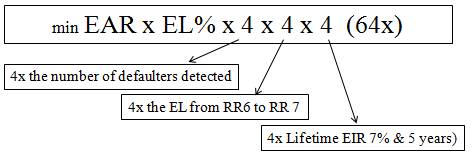

What this means is that effectively, the ECLs can be up to 64 times your current Non-Performing Loans (NPLs) for a long termed portfolio, and as much as 16 times for short termed one as follows:

- The first multiple of 4 is the increase in the number of obligors that will fall within Stage 2 once you reduce the time scale (backstop) from 90 days to 30 days. At 90 days you would have captured say around 3% of the portfolio; while for the same portfolio, the number of accounted for defaulters will be around 12% if the timeline were to reduce to 30 days.

- The second multiple of 4 is the increase in risk rating by shifting from a risk rated 6 to a risk rated 7, ie from Stage 1 to Stage 2 if cash flow analysis were to be conducted. The ECLs will increase from 3% to 12% accordingly.

- The last multiple of 4 is the NPV of term loans if the EIR were 7% and if the average life were 5 years.

All told, the changes to your Income Statement as a bank are significant.

How Important is this? You have just 19 months left to go live with IFRS 9. This means that:

- You have to capture provisions for accounts overdue beyond 30 days (not 90 days as under IAS 39)

- If it is a term loan and is rated Watchlist or worse, then the provision is over 16 times the normal

- The provisions are on Limits not Utilization and reported in the Income Statement. However where utilization is higher than limits (as seems to be evident with most banks), then you account for Utilization instead.

- You have to account for government exposure ELs (For Lebanese banks that’s a 12% provisioning)

So what you need to do NOW:

- Identify which accounts are most vulnerable

- Either restructure, change facility offerings, or exit

- Abide by all of Basel’s guidelines for Managing Credit Risk

Solution at Hand Already we can calculate 12 months ECLs for you. You simply have to provide us with two excel sheets. In addition, within a couple of months we will also have the IFRS 9 module that helps you identify:

- which accounts are most affected,

- how much are the provisions on each account and by portfolio,

- whether your portfolio is able to withstand the cost

and with the current CRS functionalities, helps you answer:

- how to strengthen your portfolio

- which industry studies you should produce

- what product programs you should use

- what facility limits should you offer each of your clients to manage the overall portfolio risk and ECLs under IFRS 9.

For those that use our CRS, next steps are: Please speak with your 6 Sigma Account Officer to help you achieve this.

What if I do not have CRS? If you are still using other systems but want to make use of our PRR and IFRS 9 modules, please contact us on ramzi.watfa@6sigmagrp.com. We will eventually need from you:

- A list of obligors with some data on each

- A list of their facilities with specific data on each

- Your PD table so that we can map it to ours (or use ours)

- Your Loss Norm table if you want to use that instead of ours (we will run two sets, one with ours and another with yours)

- A list of your Facility codes and their descriptions

- A list of your Collateral Security codes and their descriptions, along with their average period to Liquidation, and their Volatility in Value (if known).

© 2016 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”