It is not that banks fell into the trap of looking at traditional ratios and got it all wrong. It is that they ignored the advice altogether at a time when they could have done something to avoid the high Credit Risk.

Background A Jordanian company that was established in 1994, and initially was involved in the manufacture of LG products: essentially white and brown goods, and were distributed in Jordan and across the Middle East and North Africa. The company was listed on the Jordanian stock exchange, and over the years tapped into various capital markets. Its strategy since inception was to grow aggressively across its markets and be the dominant provider of white and brown goods in the region (http://www.mecgroup.jo/MEC.aspx).

How it was proposed The credit application back in the earlier 2003-2006 must have read something like this:

- LG brand name;

- Manufacturing;

- Sales of JD 38 million in 2002 (USD 53 million), increased to JD 117 million (USD 164 million) by 2006;

- Net Margin climbed from 4% in 2002 to 22% in 2005;

- Current Ratio was 1.9 in 2002, increasing to 2.4 in 2006;

- Leverage remained at below an acceptable 2:1 level throughout (reaching a low 0.99 in 2007 and a high of 2.8:1 in 2005 only);

- Expanding with lots of potential across the region;

- Access to capital market;

- Access to a wide network of local and regional banks;

- Main sponsors were of high networth and well regarded; and

- Top it all up, a very profitably account.

What bankers would not salivate at these figures during that period? Indeed some of the banks involved included HSBC, Citibank, Standard Chartered, Jeddah Islamic Bank, Opic Bank, Capital Bank, Housing Bank for Trade and Finance, Jordan Commercial Bank, Arab Bank, Egyptian Arab Land Bank, Arab Banking Corporation, Jordan Ahli Bank amongst others. However it all went badly wrong; the Credit Risk was way too high.

What happened since

- Late 2010, negotiation for debt re-scheduling started following capital increase by United Arab Investors Company (UAIC) and the National Industries Holding Company (NIG) from Kuwait (http://goo.gl/LgfBTj);

- In 2011, the LG agency was withdrawn completely (http://goo.gl/QlhNJi);

- May 2011, 15 Banks rescheduled JD103million of their debt (http://goo.gl/mFzN33);

- December 2011, sales reduced to JD 11 million (http://goo.gl/3EAy3k);

- October 2012: Kuwait’s Privatization Holding Company (PHC) signed a memorandum of understanding in which it will buy and settle the debts of the MEC of USD 182 million (http://goo.gl/BNFwtg ), representing 25 percent of the total value of the debts to 27 creditors (http://goo.gl/BNFwtg).

- 2011 financials of the company indicated that the underlying problems remained evident, NOCF negative with no sign of the company being able to ever settle bank debt. By then the Current Ratio stood at 1.15 (from a high of 2.38), and Leverage 4.13 (from a low of 0.99).

So what went wrong? Simple – No one questioned the company’s weak Cash Engine. From the financials of 2002–2008, the company continued to have a suicidal strategy, as far back as 2002 it had the wrong Business Model leading to a week ability to repay both bankers and shareholders. However, banks bent over backwards to lend to it since its inception.

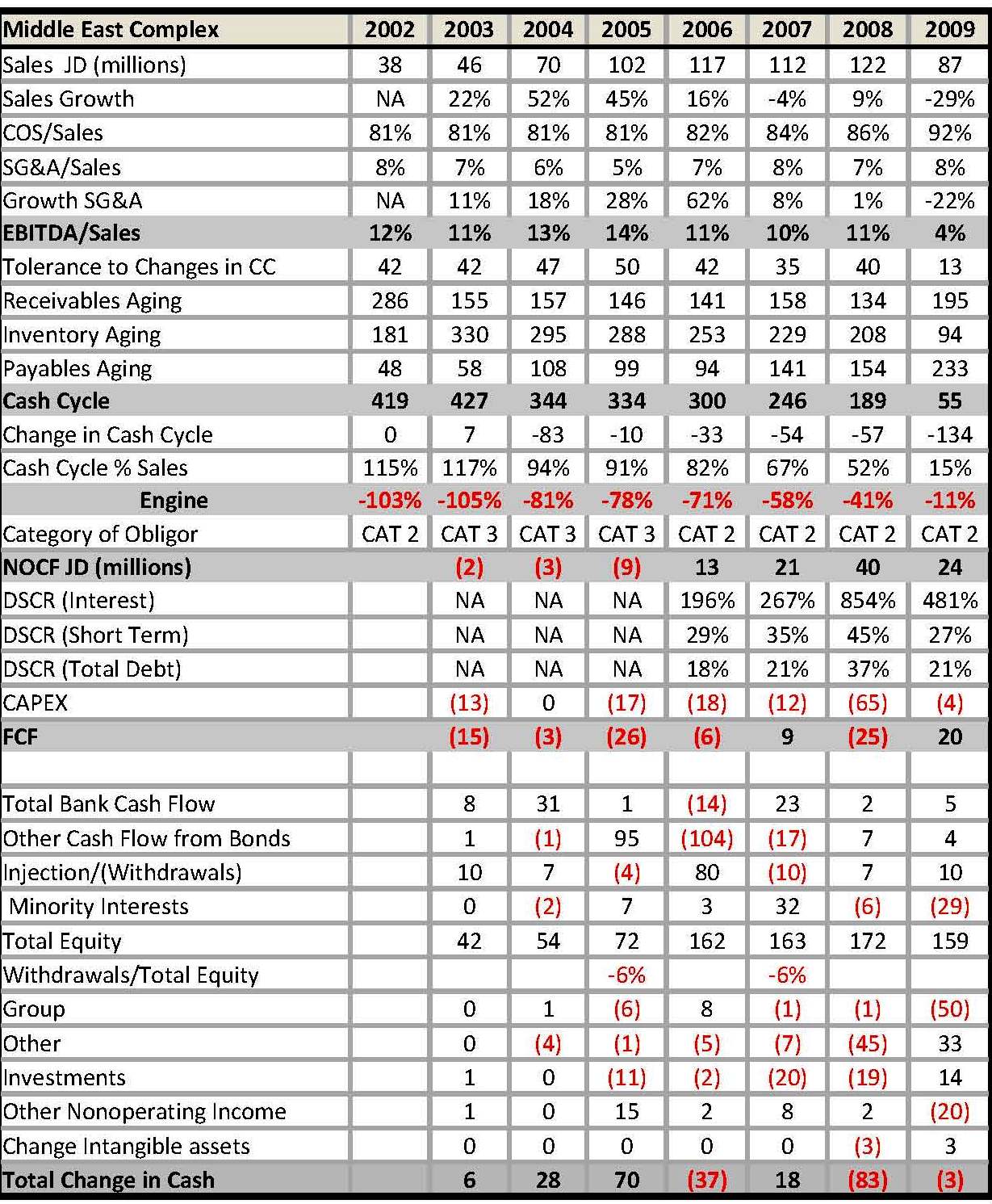

A Salable Story on the EBITDA/Sales Side EBITDA/Sales increased from 12% in 2002 to 14% in 2005, then reduced considerably from 11% to 4% in 2008 and 2009 respectively. Fair and square, all companies will have to correct themselves at some stage, if not only to take a breather.

Not a Nice Story on the Management of the Cash Cycle Side In a bid to support the expansion strategy, the company provided much support to the newly established retail and sub-franchisee outlets across the region by way of extended credit terms, with Receivable Aging reaching 286 days in 2002. Obviously bankers did not focus too much on these numbers, as they were seen as assets (in the Current Ratio) rather than liabilities (in terms of cash flow).

As if that was not enough, Inventory Aging grew from 181 days in 2002 to 288 days in 2005. As a result the Cash Cycle was an astonishing 419 days in 2002, reducing to 400 days by 2006. At these levels, the consumption of cash flow was very high, reaching the double digits; with an engine of 103%, reducing to 71% in 2006. Some support was provided by the suppliers (good luck to the Koreans, hate to see their ratios!). Obviously this support could not last forever, and it was not long before trouble resurrected.

Obviously net operating cash flows (NOCF) were negative 2003-2005, turning to very insufficient positive in later years.

How Was the Bank Debt Used? Assume for a second that the company’s banks were well aware of what was going on and that they supported the company’s vision that at some point in time, circumstances will improve and the company will be able to reduce the cash cycle and generate cash to repay everyone. How come therefore the company borrowed from the banks much more than what it required for its operation throughout the 2003 to 2008 period?

Take 2004 and 2005 as an example, when the company’s FCF stood at negative JD 3 and 26 million respectively, but the bank debt increased by JD 31 million, which in addition to bonds of JD 95 million, was mostly spent on related parties and investments.

By 2006 the burden of the added debt, and the weak business model seemed to have placed pressure on the company’s ability to repay the debt, resulting in a DSCR (total) of 18%, i.e. if the company were to (a) continue to produce JD 12 million in NOCF in future, and (b) it did nothing with the funds but repay its bankers and financial investors, then it would take it six years to cover this debt. Obviously these two assumptions will not hold true going forward, as Capex will still have to be purchased, the resulting FCFs will remain under pressure throughout the period, and the company’s business model remained far from adequate. As a result, even at that point, the company’s repayment ability was expected to remain very weak going forward.

Risk Rating During the earlier years where the Income Statement and Balance Sheet along with the traditional ratios were luring traditional bankers, the cash flows were suggesting another story. The financial rating of the company was obviously a ten, with an inability to meet even interest. Its only salvation was increased equity through renewed public offerings—to a public that was just as enamored with the company as the bankers. Even with the restructuring the company is still rated 9.67.

I wonder if HSBC’s recent decision to close down its Jordanian operation was due to this and other similar mistakes.

Why don’t bank learn from their mistakes? Back in 2003, 6 Sigma was advising some of the effected banks to be very careful, but was politely ignored.

Now, how difficult is it for banks to learn from their mistakes? Or is it that banks actually do not know what really went wrong with the Credit Risk, and that they take it for granted that losses are inevitable. If they really want to avoid situations like this in future, then why do they continue to insist on using traditional ratios to make decisions, when an alternative solution is ready at hand?

We repeat, Early Problem Recognition happens BEFORE the account is booked.

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”