I find it a little odd that with the introduction of the Basel accords, the changes that have taken place in the international banking community, and lessons that should have been learnt from the credit crises, that to this very day, the concept of Portfolio Risk Rating (PRR) is still not well understood and applied.

Central to all credit decisions, a banker’s ability to know the risk profile of the portfolio at any moment in time, and where it should be in future is paramount. Many bankers believe that by vetting credit applications and creating industry studies, their knowledge of the portfolio and their ability to manage it is complete. Alas, the portfolio has a tendency to move by itself without bankers’ help, and given limited resources, competition and lack of knowledge, monitoring of credit risk on an ongoing basis becomes very difficult. In any case, the process of “keeping an eye on the client” is micro managing the portfolio, not providing strategic macro management.

As an example, the government of a particular country decides to allocate a large portion of its budget to infrastructural projects. To capitalize on this, a bank in that country believes that it would be wise to increase its exposure to contractors to help capitalize on this sector’s growth, and requests its middle management to go after obligors in that sector with vigor. It is the bank’s belief that additional obligors from that sector should diversify its portfolio and help in its growth targets. Credits start pouring in from various officers and revenues start increasing. However the impact of adding clients of this nature on the portfolio was not studied sufficiently, with potential turnaround in fortunes in that sector having a devastating impact on the bank’s risks, despite keeping any eye on concentration limits. What would have been useful in the first instance was identifying the bank’s current Portfolio Risk Rating (PRR), and whether it was sufficiently low to withstand an increase in the risks from a sector that carries a high PRR in the first instance.

As an example, the government of a particular country decides to allocate a large portion of its budget to infrastructural projects. To capitalize on this, a bank in that country believes that it would be wise to increase its exposure to contractors to help capitalize on this sector’s growth, and requests its middle management to go after obligors in that sector with vigor. It is the bank’s belief that additional obligors from that sector should diversify its portfolio and help in its growth targets. Credits start pouring in from various officers and revenues start increasing. However the impact of adding clients of this nature on the portfolio was not studied sufficiently, with potential turnaround in fortunes in that sector having a devastating impact on the bank’s risks, despite keeping any eye on concentration limits. What would have been useful in the first instance was identifying the bank’s current Portfolio Risk Rating (PRR), and whether it was sufficiently low to withstand an increase in the risks from a sector that carries a high PRR in the first instance.

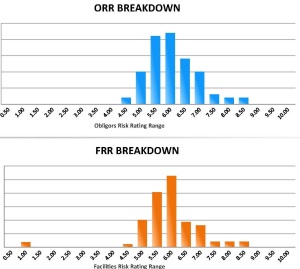

What is PRR and how is it used? The PRR is a useful calculation of the risk associated with a particular portfolio. It is used in assessing current vulnerabilities to changes, what business needs to be acquired in future in order to manage the portfolio, and how the business should be structured to manage it. If the PRR was high, say 6 and above, then the business would be wise to focus on sectors or markets that have a naturally low PRR, thereby shifting the weighted average to a more resilient portfolio mix.

The PRR is used in a variety of tasks within a bank, most notably to assess the risk rating of a particular portfolio and making decisions on how to manage it. PRRs are produced at the level of various cuts within the entire portfolio, such as by industry, by country, by relationship officer, by branch or business unit, by facility type and collateral security. It is the bank’s senior management’s responsibility to improve the value of the portfolio over time by improving its PRR.A risk rating of 6 normally carries a Loss Norm of 2.7% (Probability of Default or PD of 6% and Loss Given default or LGD of 45%); whilst a 5 and a 7 ratings carry Loss Norms of 1.5% and 12% respectively. Assuming we have an exposure at risk (EAR) of USD 100 million, the total EL for PRRs of 5, 6, and 7 are circa USD 1.5 million, 3 million and 12 million. The increase between a 5 to a 7 rating is quite exponential. So if the condition of the portfolio were to deteriorate from a 5 to 6, we would require double the amount of capital for the same level of business. If it were to increase to a 7, the capital requirement quadruples and returns to shareholders reduce by 75%. Simple arithmetic suggests that the aim of senior management should be to ensure that the PRR of the bank’s portfolio reduces with time, rather than increases. The management of a PRR is therefore central to the management of the credit business within a bank.

Strategies for Businesses, Industries, and Countries The PRR is also used to make strategic decisions across all business in the bank. For example, if the PRR of a particular industry-based portfolio were high, above say 6.5, the business would have to devise a plan on how to improve the overall PRR for that industry. It could be that the selection process of obligors in the first instance was not appropriate (typical when intelligent Target Market filtering is not used), or that the industry characteristics themselves suggest that all obligors in that industry are of high-risk profile (captured in Industry Studies that the bank is supposed to conduct on an annual basis).

Whatever the case, an action plan has to be set in place to correct that portfolio. This is done across not only industries, but also countries of operation, branches, businesses and so on. In its study, a bank should amass information to enable it to take stock of the position of each sector and plan future changes to the portfolio.

Decisions made to prune or outright wind-down a particeular portfolio would go a long way to improve the PRR of the overall bank’s portfolio over time, and as a consequence preserve the amount of capital held against it and optimize the returns on it. The portfolio requires constant intelligent pruning, which in this case means knowing which obligors need reductions in limits and increases in pricing and/or collateral security. It certainly does not mean going in with a hatchet and cutting lines left and right irrespective of obligor risk rating or category as some banks do.

The management of a portfolio using PRR assessment can be achieved easily by:

1. Ensuring the type of obligors are adequate—again Target Market selection. 2. Ensuring a diversity of obligors—reduce concentration in the portfolio. 3. Ensuring cross-sells in the facilities to reduce the overall weighted average EAR. 4. Providing appropriate limits to obligors through better structuring and matching facilities to obligor needs. 5. Enhancing collateral security. 6. Having strong early warning detection systems and remedial management programs.

If you are interested to learn more about how to evaluate business engines, subscribe to our modules on https://www.credit-risk-store.com/online-courses/credit-risk-management/

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”