RAK Ceramics has grown to be the largest ceramic producer in the world. Yes the world, competing with the Chinese, Italian and everyone else. It is the darling of the UAE, and a shining example of an emerging market company taking on the big boys. Before you ask, KPMG is the auditor. Even then, how come? What is this 23 years old company’s secret?

According to the company’s website (www.rakceramics.com), “RAK Ceramics is around USD 1 billion global conglomerate that supplies to over 160 countries and has been officially recognized as the world’s largest ceramics manufacturer with a global annual production output of 117 million square meters of ceramic and porcelain tiles, 4.5 million pieces of bathware and 20 million pieces of tableware. The Ras Al Khaimah-based public-listed company was established in 1991 ….. “.

According to the company’s website (www.rakceramics.com), “RAK Ceramics is around USD 1 billion global conglomerate that supplies to over 160 countries and has been officially recognized as the world’s largest ceramics manufacturer with a global annual production output of 117 million square meters of ceramic and porcelain tiles, 4.5 million pieces of bathware and 20 million pieces of tableware. The Ras Al Khaimah-based public-listed company was established in 1991 ….. “.

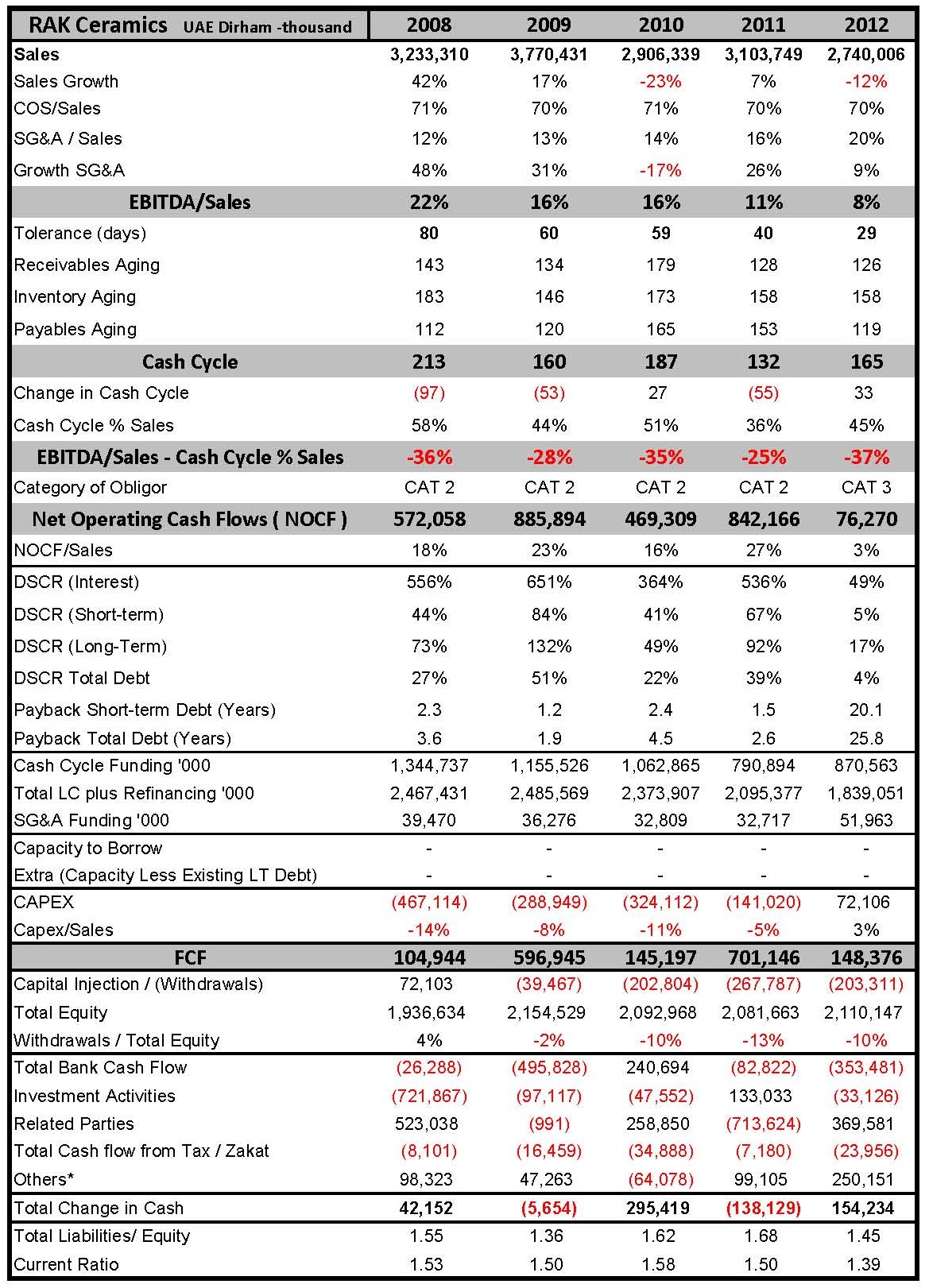

Using 6 Sigma’s Credit Risk System, this conglomerate has a financial rating of 7.68. Using our signature credit risk analysis methodology, a 7.68 company is one that has trouble meeting its financial obligations to banks. So why are banks falling over backwards to do business with it?

On the positive side: Zooming in closer on what is alluring banks to it, we find the following positive results:

- Sales of AED 2.7 bn in 2012 (USD 746 mil) excluding intercompany sales.

- Assets of AED 5.3 bn in 2012 (USD 1.4 bn) of which Fixed Assets AED 1bn (USD 283 mil).

- Acceptable Leverage of 1.45.

- Highish Current Ratio of 1.4.

- A manufacturing entity with mostly fully automated machinery.

- Owned by renowned personalities (high networth).

- Widespread across 160 countries.

In fact one can just imagine how the credit application must look like, full of pictures and discussion on the company’s innovative capabilities, product range, and how it has taken over giants in Italy and China etc etc

On the negative side however:

-

An EBITDA margin that eroded from 22% in 2009 to 8% in 2012;

-

A high Cash Cycle of 165 days (mostly stock), albeit lower than the dizzy 213 days in 2008;

-

A Category 3 obligor which generated a measly AED 76 mil in Net Operating Cash Flow (NOCF) in 2012 due to a reduction in Sales; and

-

A Debt Service Coverage Ratio of 4%, ie it will take it 26 years to repay bank debt if (a) it sustained NOCF at the above levels, and (b) did nothing with them except repay bank debt, interest free – all else being equal.

Granted this was not always the case. NOCF has always been positive, with DSCR reaching a high of 51% back in 2009. Due to the large expansion program which must have placed pressure on its overheads, the recessive years of 2009-2010 which limited growth, the company was bound to suffer a little. Surely with a presence in so many countries, it stands to reap great rewards when economies pick up again.

The Engine was always Negative and Double Digit

The company’s current negative engine is not unique or temporary. It has always been week, at a negative 36% back in 2009, and a negative 37% in 2012. Given the dynamics of this business, it is expected to remain weak going forward, and therefore its ability to meet its obligations to lenders to remain vulnerable. In fact, should sales expand in future, with such a negative engine, NOCF stands to reduce further, deepening the situation.

You cannot but wonder if the tremendous expansion of the group was due to the vacuum left behind by competitors who realized that this part of the market is not exactly a cash cow business.

So how should I finance it?

For a company that is risk rated higher than 6.5, the only cash flow that is available to repay bank debt is that arising from receivables. So receivable discounting is the way this company should be financed. This type of facility requires strict structuring as we address in our structuring facilities training program. Any other structure will place banks in a position of having to take provisions in future years, and with AED 4bn in bank debt (USD 1bn), and rising, these can amount to a lot. Should the company’s cash flow fortunes improve in future, then a more flexible financing structure can be accommodated.

If you are interested to learn more about how to evaluate business engines, subscribe to our modules on https://www.credit-risk-store.com/online-courses/financial-analysis/

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE?

You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”