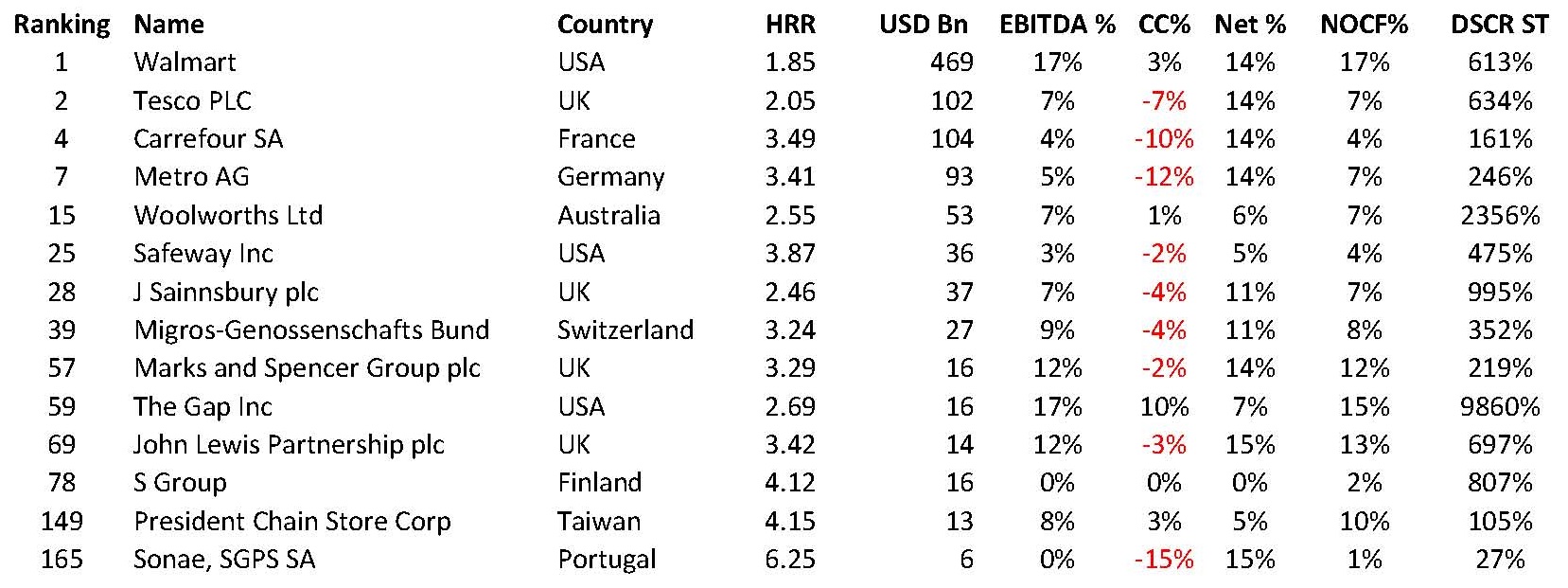

In our previous article on EMKE and Walmart, we referred to Deloitte’s recent publication titled Global Powers of Retailing 2014 (http://goo.gl/Wj4FEP), in which 250 of the largest retail stores in the world were listed, and of which EMKE Group (the Lulu chain) was reported as the 197th largest. In our same article we provided a snap shot of Walmart’s Engine using 6 Sigma’s Credit Risk System, that led to its rating of 1.85; and posed the question of whether Walmart was typical of retail stores world-wide from a credit risk perspective.

Credit Risk features of Retail stores Let us compare several retail stores that were listed in Deloitte’s table of 250 largest in terms of Size, Engine, and Traditional Ratios; and see if there was a pattern that distinguished them in terms of credit risk. The table is outlined at the end of this article. On closer examination there are certain features that you may pick up, such as:

1. The size is irrelevant in terms of risk ratings. Aside from Walmart which was rated 1.85, Carrefour was ranked 4th and rated 3.49, higher than Sainnsbury which was ranked 25th and rated 2.46 for example. This is a very good example why in banking, size matters only in terms of cross sell opportunities, not necessarily in terms of credit risk. In fact, empirical evidence suggests that the larger the company, the harder it falls.

2. EBITDA margins ranged from as low as 0% and 3% in the case of S Group (Finland) and Safeway (USA) respectively, to as high as 12% for Marks and Spencer (M&S) and John Lewis, and 17% for Gap Inc. and Walmart. Since this business is very competitive, and has a diversity of products on offer, what does a company have to do to ensure a high EBITDA margin? Is it to do with the:-

Right target market (M&S’s is very narrow, whereas Walmart’s is very competitive),

-

Product diversity (Gap is purely cloths whereas Tesco is mostly consumer products),

-

Product sourcing and distribution network (Carrefour and Woolworths are very different).

If all of the above, then where does your client stand on these issues, and how strong is its EBITDA margin?

3. What is more interesting is that with the exception of four companies, all other large retailers enjoyed zero or negative Cash Cycles. This means almost all did not need working capital support. Hang on, how do they manage to have a negative cash cycle? Obviously with low EBITDA margins, a negative cash cycle is a sure way to ensure cash generation and hence Enterprise Value. So to become a successful retailer, from a credit perspective, would you need to aim for a negative cash cycle?

4. As a result, the Engines of all of those listed were positive and (most) double digit, ranging from a high 15% for John Lewis and Sonae, to just above 0% for S Group. A positive engine is one in which more cash flow is generate as companies grow, resulting in increased Enterprise Value. So to be part of this elite group, the Engine has to be positive?

5. I would have been intrigued if there were a correlation between Turnover and Engine, with the Engine reducing with turnover. However, there are large companies with single digit Engines (Safeway with 3%) and smaller companies with a strong Engines (The Gap 17%). What is intriguing though is that with the exception of Sonae of Portugal, all exhibited very high DSCR Short Term, i.e. the cash flow that was generated was more than sufficient to meet their short term debts. Obviously financial discipline is the name of the game in this business. On the same note, Sonae which is rated 6.25, seems to be a company heading for trouble given its low DSCR ST of 27% due mostly to excessive investment activities.

6. Finally, with the exception of three companies, all exhibited Current Ratios of less than 1, and Leverage above 1.2 (except Migros of 0.6). Given their aggregate NOCF to USD 108bn that is sufficient to repay short term bank debt with ease, so much for Traditional Ratios – yet again!

As is apparent form the above, those that are successful in this business normally exhibit a positive and double digit Engine, with a strong DSCR ST. Those not exhibiting these traits perhaps should not be part of the list (using quantitative assessments). Unfortunately the financials of EMKE are private and hence could not be compared with these results.

Is it all numbers? As outlined in our previous article, there is more to retail than numbers, and the trends in technology are sifting those that are able to think out of the box from those that remain traditional in their approach. However given the above numbers, and the quantitative strengths exhibited by those that were listed, maybe these companies are indeed at the forefront of change in this industry.

6 Sigma will publish an international industry average covering quantitative ratios for the major players in this sector (excluding EMKE of course where financials are unavailable). If you are interested in receiving these results, please contact us on ramzi.watfa@6sigmagrp.com.

(HRR=Historical Financial Risk Rating; EBITDA % = EBITDA margin; CC% = Cash Cycle %; Net % = Engine; NOCF % = to sales; DSCR ST = NOCF/Short term bank debt)

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”