In our previous article on Kuwaiti companies, we addressed the point that given the relative wealth in the country, why were almost half of the listed companies we sampled in Kuwait risk rated above 6.5; i.e. watch listed or worse in terms of credit risk, using 6 Sigma’s Credit Risk System?

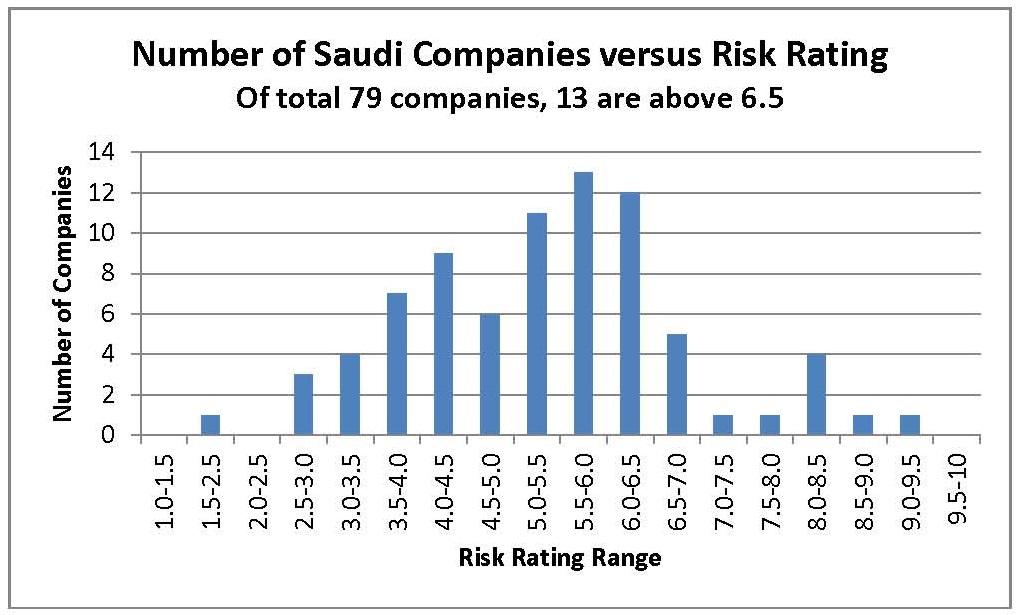

We did a similar exercise for listed Saudi companies. Of total 150 companies listed on the Saudi Stock exchange, there were 106 that were non-finance related. Of these we took a snapshot of the obligor risk rating (financials only) of 79 of them. Out of the total, 13 were rated above 6.5 (watch-list and worse).

Mismanagement on both the Obligor and Banker’s side It is a little surprising that in a country endowed with so much wealth, with a stock market that covers what should be blue chips, 17% of those sampled proved unworthy to do business with. As with Kuwait, It turns out that in addition to a somewhat weak business engines (assessed using 6 Sigma’s signature credit risk analysis methodology), their high-risk profiles were compounded by the fact that they were financed by a multitude of bankers with total disregard for not only their risk ratings, but also their needs. Interest payments are made from an ever-increasing bank debt, and as long as the balance sheets and income statements are growing, the problem is never detected.

Why don’t banks see the picture and do something about it? So why are banks seemingly indifferent or blind to this fact? Forgive us for reiterating what we outlined in our earlier article on Kuwaiti companies; but the message is the same with Saudi bankers. The problems lie with the following:

1. Lack of Cash Flow analytical techniques: It is odd when the picture is so obvious when using cash flow analysis, no one wants to use it. It seems that this concept is very little understood with most banks. In the cases where it is used, the cash flow statements generated by some risk rating systems are erroneous in their calculation, and provide the wrong message.

2. Reliance on Traditional Ratios: In almost every article we have published we discussed this very lacking characteristic, that Traditional ratios (Current Ratio, Quick Ratio, Working Capital, Leverage etc) are lagging indicators, and not useful in early problem recognition. Even when bankers have access to full cash flow disclosures with all the red flags fluttering, they continue to insist on addressing in full the current ratio and leverage ratio. It seems that having been fed these concepts since college, and everyone singing the same song, it is very hard to let go of bad habits. Evidence of their limited use can be seen in our articles on MEC and Retail Sector. On the latter, most of the largest companies in the world of retailing had current ratios less than 1.0 and high leverage ratios; yet are amazing cash flow generators with strong ability to repay bank debts.

3. Using Peer Analysis in Risk Rating Obligors: We cannot emphasize this further, if you are dealing with an obligor that can pay you back, and that you have structured your financing in line with its needs, why on earth do you spend countless hours and energy explaining why the client is above, at or below an industry average? If indeed there is another potential obligor in the same industry that is better than the one you are dealing with, then go after it as well.

Industry analysis is good for (a) identifying potential target markets so that the process of capturing quality credits is optimized, and (b) identifying credit risk traits that are particular to that industry and which may apply across many players. Unfortunately it seems that the process of Peer Analysis is used to explain ratios that in themselves are difficult to comprehend, such as whether a current ratio of 1.52 was acceptable. The only obvious answer in this case would be to compare it to an industry benchmark – the blind leading the blind syndrome.

4. Lack of Structuring of Facilities: It seems that bankers seem to lack an ability to calculate obligor needs, and tie these needs to their appetite for business based on obligor risk profiles. This has resulted in over-banking and misuse of bank lines; hence obligors’ inability to meet obligations over time. The obvious results are in the Saudi and Kuwait listed company financials. Bankers have not yet learnt their most valuable lesson: It is not about growing the balance sheet, it is about optimizing the returns to the shareholder given a particular portfolio risk.

A more elaborative description of the above can be seen in our 5 Common Mistakes in Credit Analysis which can be acquired from http://goo.gl/53ObU5.

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”