In line with Basel guidelines, and best practices, a credit risk rating system that a bank uses has to have predictive features to assess how far away an obligor is from default. The closer it is, the higher the rating. This predictive power centers on the engine of the system, which should capture a large number of characteristics and features. The more criteria it captures, the more representative is the outcome.

Traditional Ratios Are No Longer Useful The quality of analysis is in its ability to delve into events and question trends over time to help predict their future impact on the obligor’s ability to meet their obligations, in other words cash flow analysis. However this concept is relatively new, with most bankers continuing to use traditional ratios to analyze obligors. Traditional ratios include the likes of Current Ratio, Quick Ratio, Working Capital and the like. These ratios were invented back in the 1930s and were assumed to reflect the liquidity of an obligor for a given gap between current assets and current liabilities. The argument was that if the obligor were to be liquidated and their current assets were valued at more than their current liabilities, short-term bank debt would be repaid in full.

Unfortunately the use of these ratios has two major flaws:

- They are lagging indicators, being ratios of subtotals rather than actual numbers—something akin to judging a book by its cover.

- Under a liquidation scenario, the obligor would be lucky to acquire a fraction of the true value of the current assets held.

Traditional ratios had their day, and it is best to focus on other more event-driven indicators to gauge an obligor’s ability to honor its commitments. The system used to risk rate obligors therefore is best suited if it uses such methodologies.

Risk Rating Methodology In the process of risk rating, all those who are involved in the process of risk rating need to check on the methodology used to ensure that the delivered outcome is in line with expectations. Any decent risk-rating system should be forward-looking and therefore a predictor of default BEFORE it happens. This would be evident once the system is validated, whereby those obligors that are rated high are indeed defaulting obligors, and those that are rated low experience low incidents of default. Also the need to check for “passing the hat”, settling bank debt from other bank lines and not from operations, also needs to be identified as a default, and embedded in the risk rating methodology.

So what do we do once we risk rated obligors? Simply manage Probability of Default. The risk rating will help manage the portfolio by allowing the bank to:

- Choose its obligors carefully in the first instance: Target Market Selection

- Clearly define the terms and conditions it is willing to provide: Risk Acceptance Criteria

- Understand the industries its obligors operate in: Industry Studies

- Assess obligor financial status appropriately

- Assess all other qualitative criteria that are outside the financial statements, and

- Structure the facilities and exposure appropriately in line with the risks, and understand the risks associated with all products offered: Product Programs.

To get a better understanding of managing Probability of Default (PD) and Loss Given Default (LGD), see our previous article on “How do you manage Credit Risk at your bank?”.

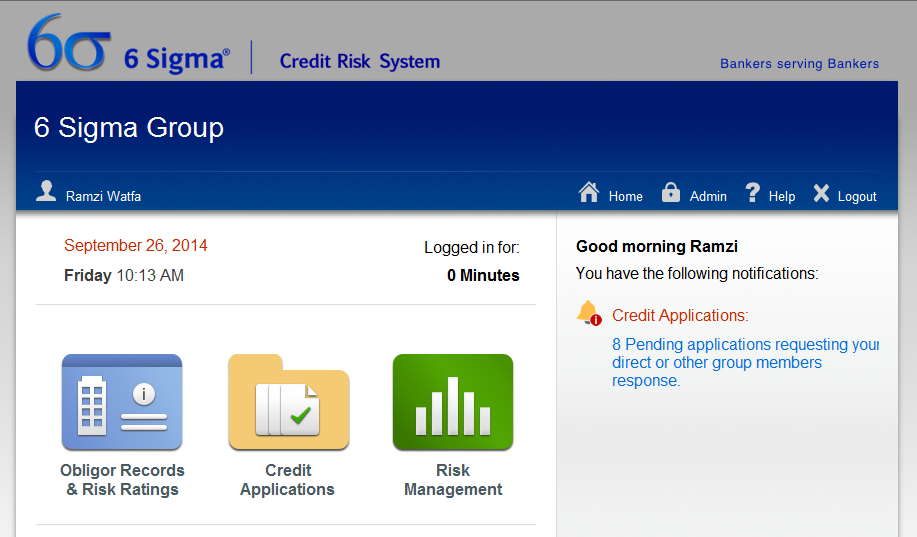

Target Market and RACs At 6 Sigma Group, we created a system of measuring credit risk that accounts for 177 different criteria, the largest of any system available in the market. These criteria cover both financial and non financial attributes, and are based on four major pillars: numerical data, and assessments of management, industry and the environment (economic and political).

Very soon we will introduce another layer of assessment that takes credit risk assessment to another height altogether. This is with the introduction of Target Market and Risk Acceptance Criteria. These are a set of assessments that are both numerical and non numerical in nature that are unique to individual obligors. These are specific to the obligor’s sector (eg contracting), business (SMEs), facility type, pricing and share of wallet (RACs), and adherence to covenants. By adding this extra level of assessment, and assessing the number of deviations from the set norm, the system would be able to:

- Reject credit proposals if the number of deviations are above a certain threshold;

- Override the obligor risk rating to a certain level;

- Increase the obligor risk rating by a pre-set increment; and/or

- Increase the level of approval of the credit.

If our current automated credit proposal helps reduce decision making from weeks to hours, then this added level of assessment will streamline the process tremendously beyond all that is available in the market. We encourage you to check what is offered today, and keep in tune for future developments. A demo of the system is available on our website on http://goo.gl/CHdNhk.

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”