Tesco is the Second Largest Retailer in the World In our previous article headed “Is there a Credit Risk characteristic to the Retail sector?” (http://goo.gl/fqT7e3), we referred to Deloitte’s recent publication titled Global Powers of Retailing 2014 (http://goo.gl/Wj4FEP), in which 250 of the largest retail stores in the world were listed. In that report, Tesco came out as second largest with a turnover of GBP 64Bn. Using 6 Sigma’s Credit Risk System, that provided it with a credit rating of 2.05 (out of 10).

What happened then? With the disclosure of half year numbers, Tesco seems to have suffered along the following fronts:

- Sales Slump: Apparently the group experienced a 4.6% annual decline in UK sales. It seems that customers are turning their back on Tesco which is perhaps no longer seen as the best of the Big Four for price or quality.

- Increased Competition: This decline was also attributed to discounters such as Aldi and Lidl, reducing its market share from 30.2% to 28.8% according to Kantar Worldpanel data.

- Lower Profits: In the process, profits slumped to GBP 783 million, down almost 47% on the previous year, which includes several one-off items, including an adjustment related to overstated profits (see Accounting Discrepancy below).

- Accounting Discrepancy: The company had a minor, but seemingly important financial disclosure discrepancy. At the company’s behest, Deloitte’s investigation discovered that profits were overstated by GBP 118 million in the first half of this year, by GBP 70 million in the 2013/14 financial year and about GBP 75 million prior to that. This discrepancy apparently relates to reporting revenues from suppliers without matching their costs in the same accounting period (breaking a cardinal rule in accounting).

Like all retailers, Tesco made deals with suppliers over promotions, but it seems it booked returns from those promotions too early, while deferring their costs. For a business that was predicting GBP 1.1bn profits for the first half of this year, a misstatement of 23% may be seen as a significant number. No one suspects individual foul-play yet, but it seems that Tesco’s internal culture for a higher bottom line, a more aggressive policy than its peers with regards to revenue recognition, depreciation, and property-profit allocation may have led to this mistake.

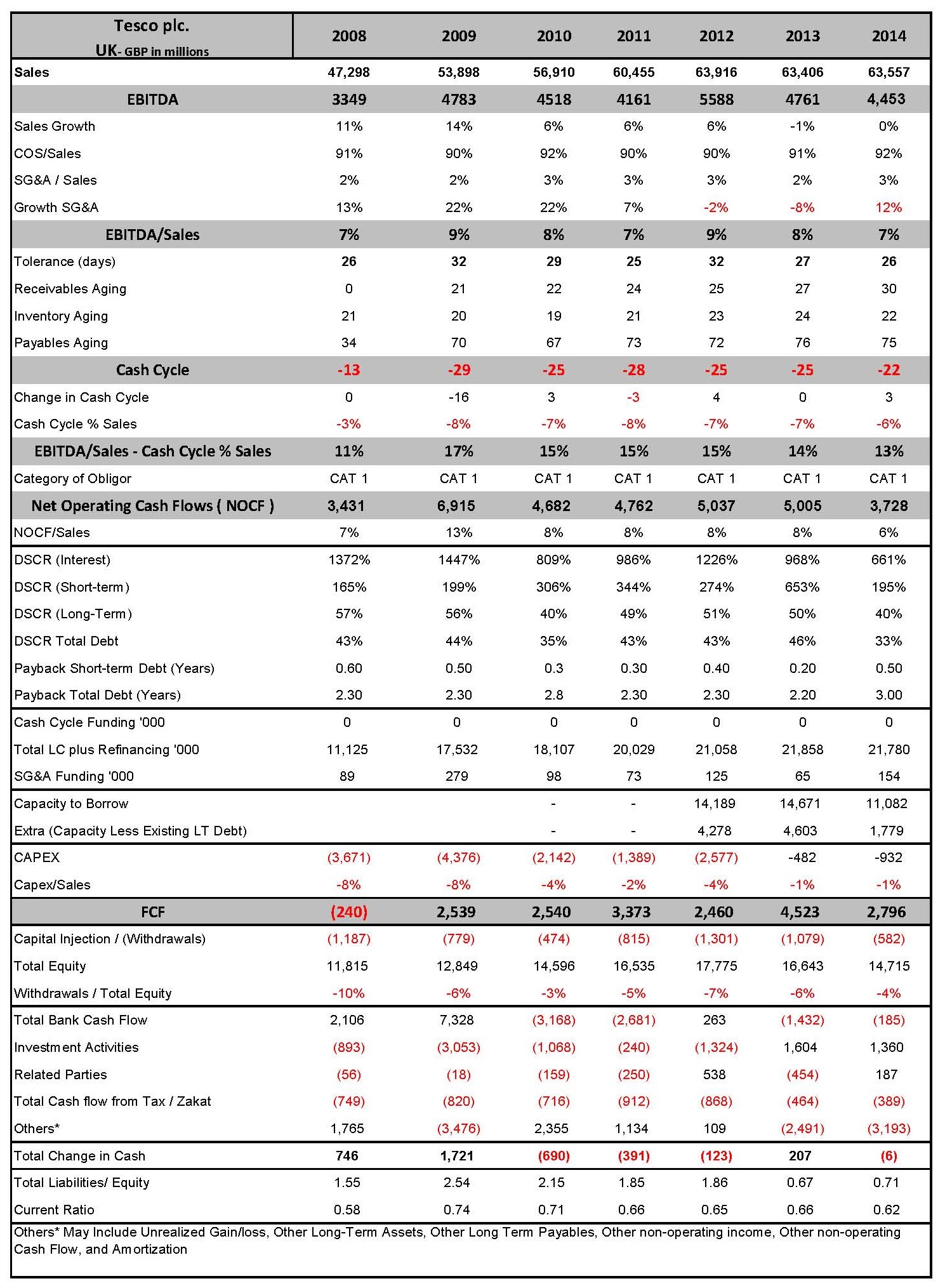

Is the impact of all of the above that great from a Credit Risk perspective? From the numbers that were just downloaded (below), and by using 6 Sigma’s Credit Assessment methodology (http://goo.gl/L353Cb) Tesco still has very strong credit risk features, such as:

- Steady EBITDA of 7% to 9%, weaker in fiscal 2014;

- A negative Cash Cycle of 22 days, which is typical of these large retail stores;

- A very positive Engine of 13% (albeit lower than the 17% experienced in 2009), but which provides it with a Category 1;

- As a result a slightly lower but positive NOCF of GBP 3.7Bn or 6% of sales (versus mostly 8% in prior years);

- A very high DSCR of 195% (short term) and 33% (total debt); and

- An acceptable behavior in terms of all other items.

On the negative side:

- Yes, flat sales in fiscals 2013 and 2014, and it seems from mid year results for fiscal 2015, a decline.

- However, even if the GBP 70 million discrepancy for fiscal 2014 were to be removed from EBITDA, the net impact is a negligible 0.1% of sales.

As a result of all of this, up to fiscal end 2014, the company was rated 2.7 on the historical performance up from 2.05 a year earlier, and a slightly higher 4.14 overall Financial Rating due to expected volatility in performance. However, 4.14 is still within the investment range, and very acceptable all told.

Is it all numbers? As outlined in our previous article, there is more to retail stores than numbers, and the trends in technology are sifting those that are able to think out of the box from those that remain traditional in their approach. Tesco conducted several experiments over the years to push the envelope a little, including opening small community stores, providing online shopping experience, and venturing strongly into organic foods. Some may or may not work, and despite all the criticism, the company is still a very acceptable credit risk.

Amazon also has a very shallow bottom line as well, and it is a cash cow Compare this with Amazon which displays similar low profitability, and is able to generate phenomenal cash flows due to the same negative cash cycle characteristics. The Harvard Business Review article above discussed how with all the cash flow Amazon generates, it is able to experiment and push the envelope further without having to resort to diluting shareholder value. The same case can be said of Tesco. OK the company may have to think further with regards to regaining market share, but in this business, it takes time to prove success.

So was the resignation of the Chairman and the ensuing market panic justifed? The freakiness of the market with its maniacal focus on net profits is totally unjustified, given the group’s sustained cash generating capability. In fact, we believe that Tesco’s share price is perhaps under-valued under the circumstances. However, what is totally justified is the accountability for significant book-keeping mistakes that were pushing the wrong envelope altogether. The cardinal rules of accounting should not be altered, lest all trust in the numbers dissipates, leaving the analysts with little to work with. The Chairman’s head along with others in the organization was well justified in this case. However the market panic was not.

6 Sigma will publish an international industry average covering quantitative ratios for the major players in this sector. If you are interested in receiving these results, please contact us on ramzi.watfa@6sigmagrp.com.

© 2014 6 Sigma Group

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”