On 3 November 2014, Mobily disclosed financial irregularities in its accounting practices. As a result, its share price dropped 30 percent, and its CEO was recently suspended. This disclosure also affected the reputation of Etisalat, the UAE telecom operator who owns 27 percent of the company and provided technical and management support; and more importantly Deloitte, the auditor who has since been suspended from doing any business with listed Saudi companies by the country’s Capital Market Authority. So what went wrong with this credit risk?

Fraud by any measure In our earlier article on Fraud http://goo.gl/NLrduy, we highlighted the ways companies can and have conducted fraud in reporting their financials. Being such a large company, with adjusted sales of SAR 15.8 Bn (USD 4.3 bn) as of end of 2014, Mobily should have known better, and the financial errors were a testament of serious defects in the company’s management. In addition, had this incident happened in the US or Europe, then Deloitte would have followed in Arthur Anderson’s steps when it folded following the Enron case. Perhaps court proceedings are yet to materialize once all the investigations are concluded.

So what did Mobily do that was so bad? Although the final investigation by Etisalat is yet to be finalized, it seems that the company reported revenues on contracts that were yet to mature. These are the contracts in which future installments are recognized by the company in full value upfront as revenue. Obviously in accounting this is a big NO-NO as you only report revenues once the service has been delivered not contracted, especially when there are opt-outs in the contracts. You cannot treat Operating leases as Capital leases simply because ownership will shift at the end of a contract.

I guess with so many bonuses at stake (CEO reportedly earned on average SAR 30 million every year), and withdrawals by shareholders of SAR 13.1Bn (USD 3.5Bn) since 2010, the parties involved where happy to book the deals (akin to the faults we highlighted in our earlier article on How We Make Credit Risk Decisions http://goo.gl/wWTEcQ).

How did the banks react? In their published analysis on the issue, AlBilad Capital, a Saudi bank claimed the stock was undervalued (http://goo.gl/8egcf8). Practically all the other banks were discouraging investments in the stock. In addition, now that a few months have passed since the reporting, it seems that all banks that were providing the company with credit lines have since tightened their support in terms of covenants and lower limits.

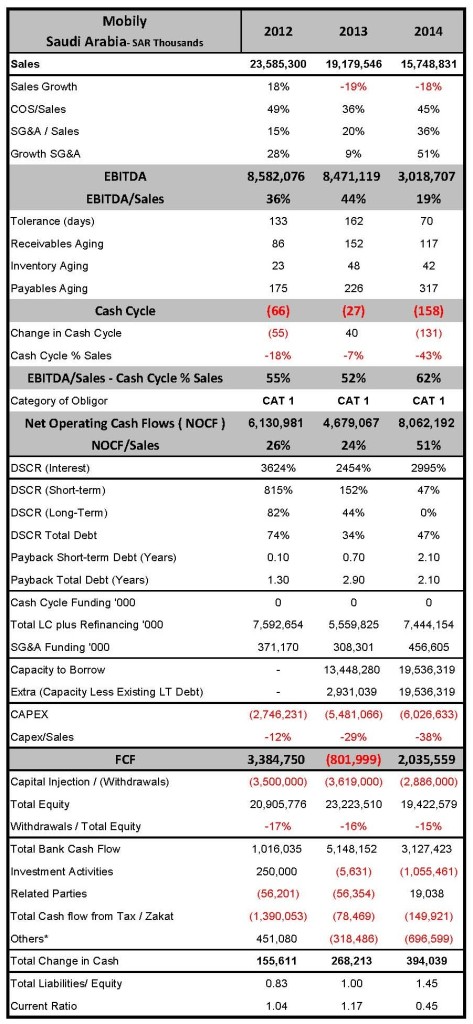

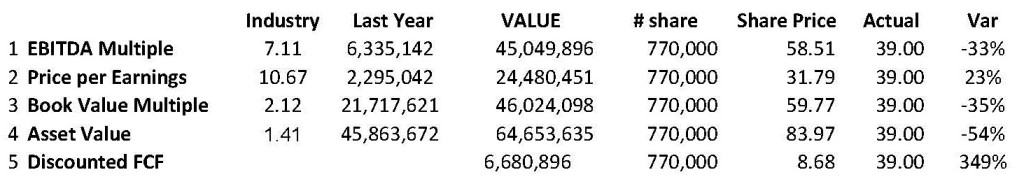

Does this have an impact on Mobily’s Market Value? Now that the figures for 2014 have been revised (hopefully without any more surprises), let us have a look at the financial highlighter for the company (below) which indicates that the company produced a free cash flow of SAR 2bn (USD 555 million) in 2014. Projecting this over a 6 year period, and using a WACC of 10%, and a growth rate of 5%, its Discounted Enterprise Value comes to around SAR 6.6Bn (USD 1.8Bn). With 770 million shares outstanding, this translates to a price per share price of SAR 8.7, far lower than the current price of SAR 39. So from a DCF point of view, the company is way over-valued. However we find this as typical of most listed Saudi companies, a result of over-exuberance in both liquidity and market practices (another topic for later discussion).

Perhaps AlBilad Capital was using multiples to arrive at valuation. With the other two operators in the kingdom STC and Zein as comparison, Mobily would be mostly under-valued as indicated below:

Does this have an impact on its Credit Risk?

From a credit risk stand point, aside from the obvious high management risks arising from the malpractice, the financial risks (again assuming no more surprises), indicate a very healthy position:

Does this have an impact on its Credit Risk?

From a credit risk stand point, aside from the obvious high management risks arising from the malpractice, the financial risks (again assuming no more surprises), indicate a very healthy position:

- EBITDA margins of 19% (albeit reduced form the dizzy heights of 40% in 2013)

- A negative Cash Cycle of 158 days

- Resulting in a very positive and strong Engine of 62% and

- NOCF to sales of 51%

- Despite Capex to Sales being high at 36% (including licensing fees), and Withdrawals of 100% of profits, the company enjoyed an acceptable Total DSCR of 0.5. OK the Short Term DSCR of 0.5 can do with a makeup. Had the owners not withdrawn SAR 13.1Bn (USD 3.5Bn) since 2010 and instead lowered reliance on bank debt, the DSCR would have been much higher.

This is why the company is rated 4.86 on historical financials in our Credit Risk System. This rating is adjusted slightly upwards due to the volatility of the company’s numbers. So from an investment point of view, the company is not worth the price; and from a Credit point of view, it is worth dealing with it.

So is the alarmist fever necessary? From a traditional point of view, the company’s Current Ratio was a low 0.4 (it was always low), and its Leverage increased to 1.4; which coupled with irregularities no doubt played a role in the bankers’ tough actions. As outlined in our previous article on Fraud, if you were a traditional banker who tirelessly examines balance sheets and income statements, changes to these will create havoc in your psyche. It would be wise to use cash flow in analyzing credits instead, as exaggerated numbers in the income statement are canceled by counter-exaggerated entries in the balance sheet (basis accounting methodology for cash flows).

Should the company and its owners take matters seriously? Absolutely. Accountability at Mobily, Etisalat and Deloitte should be severe to say the least. However banks would be wise to take a more sober attitude and examine cash flow repercussions going forward instead.

For more details on our training modules, please visit www.credit-risk-store.com

While the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it:

“6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”