The main problems with the various approaches to calculating IFRS 9 impact today are as follows:

The main problems with the various approaches to calculating IFRS 9 impact today are as follows:

- Defining Significant Risk and Calculating Shifts in Ratings

- Switching back to original state after a period of time

- Using the wrong Effective Interest Rate

- Thinking that you can defer the problem on 30 days

So when does the count start for changes in risk rating?

Some banks are literally calculating changes in rating since inception. Imagine. Surely when we suggest “inception” it is not the inception of the relationship, but the exposure itself. So for short term facilities such as overdrafts, the clock is re-started every year on the review date; NOT on the date the facility was first provided (in some cases more than 10 years ago). In addition, working capital financings should continue to be treated as a 12 months exposures throughout. To be doubly sure of this, ensure that offer letters to clients incorporate clauses such as Maturity of Availability Period, Changes in Circumstances (MAC), Exposure Automatically Expiring at end of availability period unless advised otherwise in writing and so on.They had to invent the shift in ratings as a proxy for “Significant” shift in ratings.

If you were to use a cash flow centric risk rating methodology, then you can judge a shift in Stages easily using the obligor risk rating, with those not having sufficient cash flows to meet near term obligations being risk rated above 6, i.e. classified Stage 2+. This is particularly applicable if the rating itself included qualitative measures, and stress testing (sensitivity analysis). For those of you using a traditional “z-scored” systems (Moodys, S&P, SunGard etc) then the recognition of shift in ratings becomes a dilemma. Let’s have a closer look at the rule:“The Standard considers credit risk low if there is a low risk of default, the borrower has a strong capacity to meet its contractual cash flow obligations in the near term and adverse changes in economic and business conditions in the longer term may, but will not necessarily, reduce the ability of the borrower to fulfil its contractual cash flow obligations. [IFRS 9 paragraphs B5.5.22 – B5.5.24]”

In our cash centric terminology, that means the Risk Rating of 6 or below.And once it goes to Stage 2, when does it revert back to “normal”?

“ IFRS 9 also requires that (other than for purchased or originated credit impaired financial instruments) if a significant increase in credit risk that had taken place since initial recognition and has reversed by a subsequent reporting period (i.e., cumulatively credit risk is not significantly higher than at initial recognition) then the expected credit losses on the financial instrument revert to being measured based on an amount equal to the 12-month expected credit losses. [IFRS 9 paragraph 5.5.11]”

So in the world of cash flow centricity, if the risk rating were to return to 6 or below, then the 12 months ECL kicks back in. Obviously in the credit analysis, the causes for a shift in rating would have to be examined and justified. Justified does not mean found a reason for it, as everything has a reason. Justified means it is not due to a deterioration in the obligor’s cash engine, its ability to generate cash flow to be sufficient to meet bank obligations. For example, if the obligor were to withdrawal too much cash from the business, and its Debt Service Coverage Ratio (DSCR) deteriorates as a result, then it is classified a Stage 2. If in the following year it continued to generate cash flow but did not withdraw funds, instead using the cash flows to lower bank debt and improve its DSCR, then it can be reclassified a Stage 1. However if the shift in risk were due to an inability to generate cash flows in the first place and the engine remained weak year on year, then the obligor would remain in Stage 2. Here’s the catch though. Some bankers (including Central Bankers such as the Qataris) think that the resolution to a shift is simply a waiting game, the obligor can shift back to its original Stage after a “curing” period (in the case of Qatar one year). This is obviously contrary to the spirit of the exercise.The absurdity of calculating shifts in ratings

This scenario is not what you will face if you were using a non-cash flow centric risk rating methodology. Hopefully the bank would have investigated the situation from day one (long before the incidence of default) and took effective measures (reduced exposure, changed the type of exposure, etc) to mititgate the impact. However due to deficiencies in non cash flow centric rating systems, the delimiters between Stages 1 and 2+ are very fuzzy. For example:- Assume an obligor’s rating were to increase not so “significantly” from say 4 to 5, how can you still be sure it is able to cover its near term obligations to banks if your rating is not cash flow centric?

- Systems that are not cash flow centric use a proxy to determine “Significant” shift in risk ratings. So you may have two accounts, with the rating of one changing from 3 to 5 and another from 4.5 to 5. Both are still rated 5 (and in a cash centric system it is a Stage 1 rating), but the 3 to 5 shift is considered Significant, whilst the other not. I know it sounds very silly, but other systems are silly!

The Effective Interest Rate is not etched in Stone. It Varies!

EIR is the current rate: “Expected credit losses shall be discounted using the effective interest rate determined at initial recognition or an approximation thereof. If a financial instrument has a variable interest rate, expected credit losses shall be discounted using the current effective interest rate determined in accordance with IFR 9:B5.4.5”Why is Everyone so fixated by the LGD all of a sudden?

We started using LGD and EL at the collateral level 13 years ago. Now that other systems are selling it as a separate module and charging an arm and a leg for it, everyone seems to be obsessed with it. Please remember, the LGD is a weighted average between the collateralized EAR and its clean portion. The LGD associated with each collateral has its own supporting study outside IFRS 9. The collateralized portion of EAR is also time-sensitized with haircuts, volatility and discounted periods. How you calculate LGD will require evidence through studies etc., which most banks are not geared to do. In fact most will stick with the Basel’s standard 45% for IRBF. Again, what’s with the fuss on LGD?Inability to Defer the inevitable. Rebuttable is preemptive not a deferral.

Do you think the 30 days rebuttable is a means to allow you to postpone recognizing Significant increase in risk? Think again:“Regardless of the way in which an entity assesses significant increases in credit risk, there is a rebuttable presumption that the credit risk on a financial asset has increased significantly since initial recognition when contractual payments are more than 30 days past due. The rebuttable presumption is not an absolute indicator that lifetime expected credit losses should be recognized, but is presumed to be the later point at which lifetime expected credit losses should be recognized even when using forward-looking information (including macroeconomic factors on a portfolio level). Consequently when an entity determines that there have been significant increases in credit risk before contractual payments are more than 30 days past due, the rebuttable presumption does not apply as a significant increase in credit risk has already been identified (IFRS 9:5.5.11 & B5.5.19) .”

Translated: Rebuttable means you can mark the account as Stage 2 BEFORE the 30 days is due. It does not mean that you can postpone the marking of Stage 2 even after 30 days. Throughout the history of modern banking (since 1980s), the ethos was and remains to “call a spade a spade”. If the account reached 30 days and you have an inability to do proper risk rating, then you place it in Stage 2. Period. If you were able to see things well ahead using a cash centric risk rating methodology, then you have the option to declare the account a Stage 2 even before the 30 days backstop is reached. That is what Rebuttable means.Next Steps – VALIDATE YOUR RISK RATINGs.

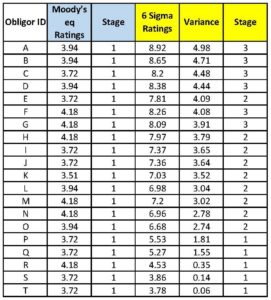

Here’s an example of a client who asked us to run a sample of accounts on our cash centric system and outline the differences with its (antiquated, archaic, z-scored system). The results were shocking: As you can see, where the bank thinks that all is OK and the accounts are in Stage 1, in fact most of them should be captured as Stage 2 and 3.

So if the bank were not to do anything, thinking that all is swell and portfolio is full of flowers, and birds etc, it will experience what we call the Doberman’s effect. The bite from nowhere that will hit the bank so hard, not on one but many accounts, rendering the bank incapable of survival without serious shareholder funds. To make matters worse, shareholders will not be very pleased when they realize that the mistakes could have been avoided from the start ……

Validate your ratings quickly so you have time to do something about the Dobermans. How to do it you say? Contact us on ramzi.watfa@6sigmagrp.com

As you can see, where the bank thinks that all is OK and the accounts are in Stage 1, in fact most of them should be captured as Stage 2 and 3.

So if the bank were not to do anything, thinking that all is swell and portfolio is full of flowers, and birds etc, it will experience what we call the Doberman’s effect. The bite from nowhere that will hit the bank so hard, not on one but many accounts, rendering the bank incapable of survival without serious shareholder funds. To make matters worse, shareholders will not be very pleased when they realize that the mistakes could have been avoided from the start ……

Validate your ratings quickly so you have time to do something about the Dobermans. How to do it you say? Contact us on ramzi.watfa@6sigmagrp.com