This is the second of our analysis on Egyptian companies series, and another one that has a low risk rating of 3.39 (using 6 Sigma’s Credit Risk System). Another investment grade company par excellence, what we consider at 6 Sigma as Category 1 company from a credit risk perspective.

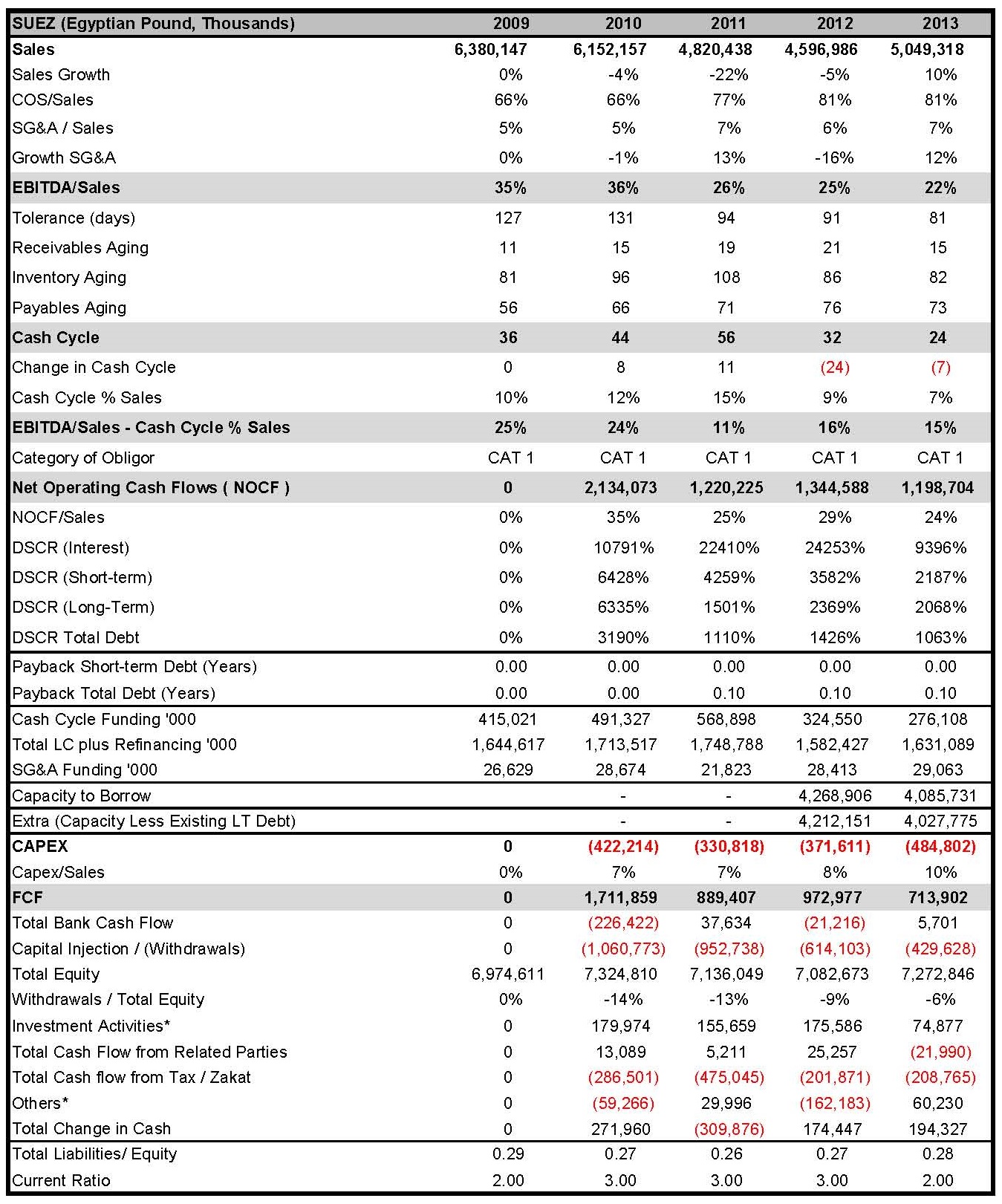

Using 6 Sigma’s signature credit risk analysis methodology, a “Category 1” company is one that continues to generate cash as it grows. As reflected in the company’s 2013 financials, Net Operating Cash Flows (or NOCF) reached a high of EGP 1.2Bn (USD 161 million), an impressive 24% of sales (albeit much reduced since 2010 – see table below).

On the positive side: The reasons for this seem to be in its strong engine, as the following:

- High EBITDA margin of 22% of sales, albeit reduced from 35% in 2009,

- Sustained low cash cycle of 24 days (from 36 days in 2009). This represented 7% of sales, which compared with the high EBITDA provided for a Positive Engine of 15%.

- To top it all up, its DSCRs were very healthy, so ample cash flows to meet bank obligations.

- With a high and positive NOCF, and 10% to sales expenditure on Capex, the company managed to produce EGP 713 million in Free Cash Flow (albeit reduced dizzy heights of EGP 1.7Bn back in 2010).

So where are the red flags? Egypt’s cement industry was facing major challenges; continuous electricity cuts and energy supply shortages that impeded production, along with a continued string of labor strikes that have been rampant since the 2011 revolution. In line with market and other peers, SUEZ’s sales decreased by 28% from a high of EGP 6.4Bn in 2009 to EGP 4.6Bn in 2012; and only managed to recover in 2013 with an increase of 10%.

Management of Costs In 2013, the political situation in the country stabilized, and a switch in energy source to coal from gas and diesel to overcome fuel shortage and expected increase in fuel prices helped put a lid on increasing costs (at the expense of the environment of course). Aside from a 10% increase in sales, COGS to Sales remained stable at 81% in 2013. However that was a far higher level than the 66% in 2009, and as a result its EBITDA margins reduced from 35% in 2009 to 22% in 2013.

To maintain stability going forward, the company’s main shareholder, Italcementi is planning to enter into wind power generation which should help secured power for Suez going forward. However it is a novel idea in a region that is not renowned for its windy conditions.

Reduction in EBITDA margins was offset to some extent by a reduction in the Cash Cycle Receivable agings remained fairly stable and low at 15 days in 2013. Stability also returned to inventory agings, reducing from 108 days in 2011 to 82 days in 2013. Both these changes were a reflection of a strong comeback for the construction and building materials sectors following the political upheavals, despite the fact that the demand was mainly generated by small and mid-size projects. This trend was also supported with enhanced quality initiatives in the company.

Hence the Cash Cow The company’s engine remained positive at 15% in 2013, clearly a Category 1 company. However the events that enveloped the country meant that the company lost close to 10% of its sales in cash flow since 2009. That’s close to EGP 505 million. Whether it is able to sustain a 15% engine or not is yet to be seen.

At existing levels though, the company is well able to meet all its banking commitments, with DSCRs well above norms. The company does not leverage its bank lines, with total leverage remaining very low at 0.3 in 2013. No wonder its Credit Risk Rating is so low.

Capex is mainly for upkeep The company’s Capital Expenditure program is focused on the reconstruction and modernization of its existing production facilities in order to reduce costs, improve processes and increase utilization capacities. Expansion plans under current conditions is not in the offing.

For Investors, they seem to get less In short, a tight ship that has weathered the affects of the revolution; and lessons learnt should help it maintain a healthy engine going forward. Perhaps there are red flags within its operations that are not apparent in the numbers. If you know any, please share them with us.

From a shareholder perspective, returns on equity reduced over the years from 14% in 2010 to 6% in 2013. I would have suggested that with seeming return to stability in the country, the company would be ripe for takeover, increased leverage and the sucking of its cash flows. Any takers?

If you need help understanding all of this, please contact me on ramzi.watfa@6sigmagrp.com, or simply share your views on the Comments box below. © 2014 6 Sigma GroupWhile the information contained herein is believed to be accurate, neither 6 Sigma nor any of its affiliates or subsidiaries or its employees makes any representation or warranty, express or implied, as to the accuracy or completeness of the information set out in this document or that it will remain unchanged after the date of issue of this document, and accordingly neither 6 Sigma nor any of their respective affiliates or subsidiaries or employees has any responsibility for such information. This document is not intended by 6 Sigma to provide the sole basis of any credit decision or other evaluation and should not be considered as a recommendation by 6 Sigma that any recipient of this document should purchase an equity stake in, provide credit facilities to, or conduct any business with any company(ies) listed in this document. Each recipient should determine its interest in the information provided herein upon such independent investigations as it deems necessary and appropriate for such purpose without reliance upon 6 Sigma.

WANT TO USE THIS ARTICLE IN YOUR NEWSLETTER OR WEB SITE? You can, as long as you include this complete phrase with it: “6 Sigma Group teaches bankers around the world how to become better bankers. Get the “5 Mistakes Bankers Do in Credit Analysis” at www.credit-risk-store.com”