How to Manage Credit Risk in Name Lending

Why is Suez Cement’s Credit Risk so low?

What are the Credit Risk impact of Tesco’s accounting scandal?

What to do with Credit Risk Ratings?

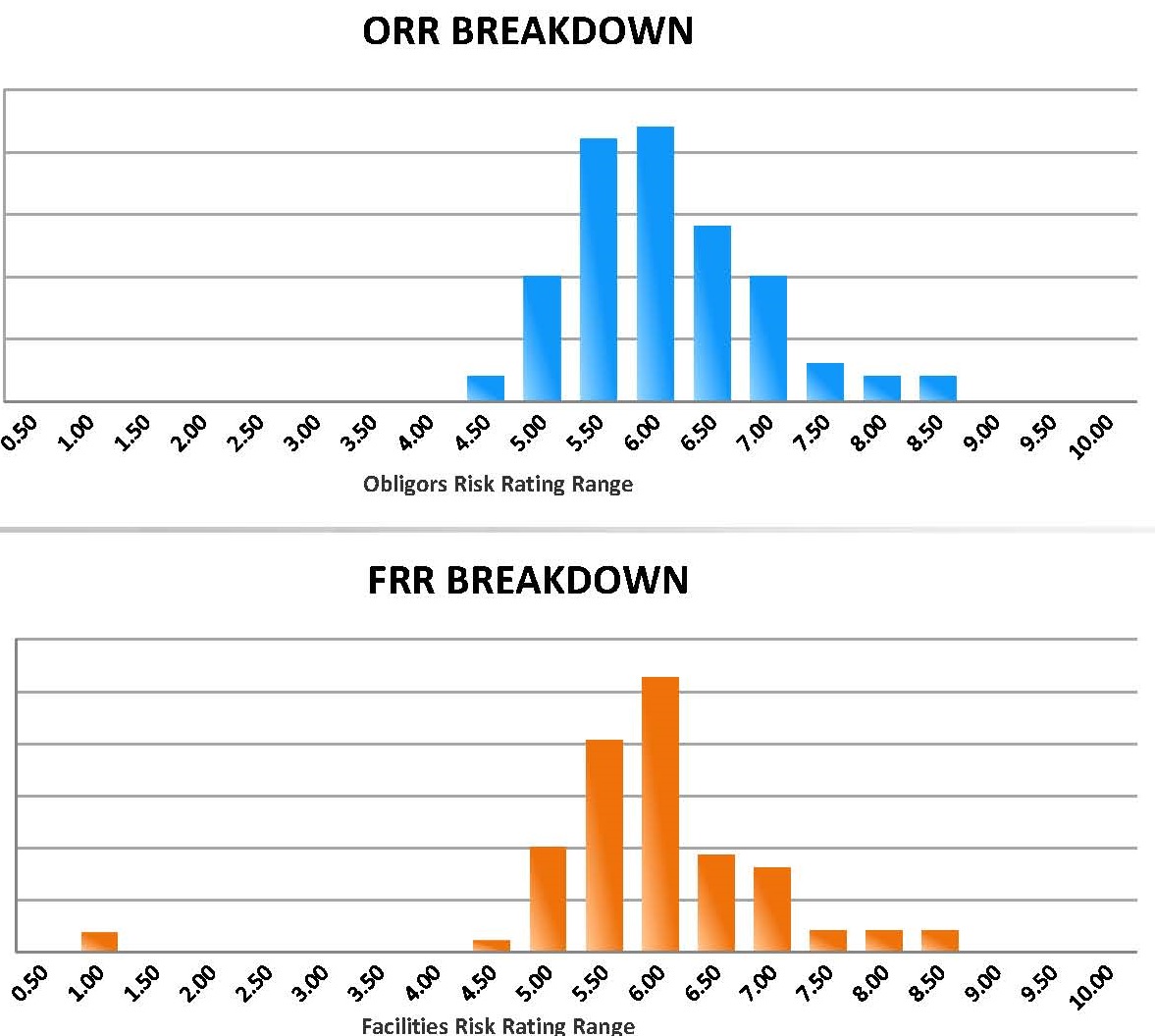

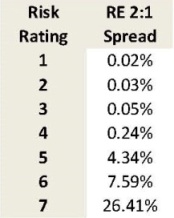

Portfolio Risk Rating in Managing Credit Risk

What does IRB Compliance really mean in Credit Risk?

Are all schools in the GCC low Credit Risk rated?

Why Standardized banks should operate as IRB for managing Credit Risk

Ponzi Schemes: A special Credit Risk feature

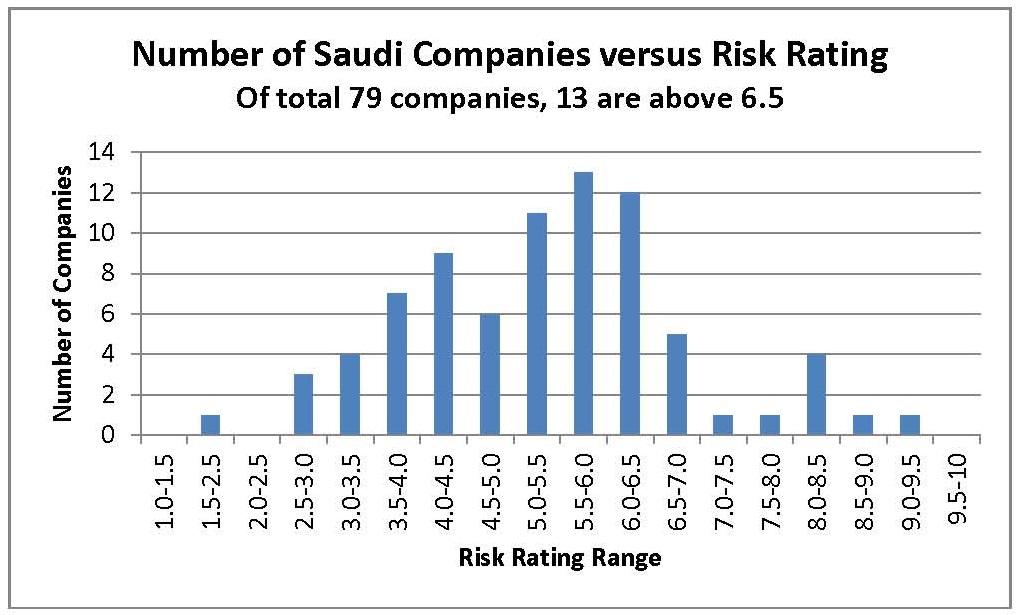

How Risky is a Saudi Portfolio? A selection of Credit Risk Ratings

Get the

5 Mistakes

Bankers Do in

Credit Analysis

You’ll discover what the 5 mistakes are and how to avoid them.

PLUS, you’ll get a free subscription to our weekly newsletter.

We promise to never sell, rent, trade or share your email with any other organization.

Browse the

Credit Risk Store

The simple methodology used in our Essentials of Accounting online course allows you to understand ...

Learn More About This E-Course HereThis Financial Analysis online course shows you how to assess the company’s business model and its ability ...

Learn More About This E-Course HereSigma’s Credit Risk Management online course series are intended to introduce methodologies that makes credit ...

Learn More About This E-Course HereThe Portfolio Risk Rating and Stress Testing online course is designed to help you understand how to create ...

Learn More About This E-Course HereThe Facility Structuring online course shows you, step by step, how to identify both the short-term and long-term ...

Learn More About This E-Course HereIf you’re already analyzing obligors, and generating credit risk ratings for individual clients, this Credit Analysis ...

Learn More About This E-Course Here